China's AI Boom: Powering Global Innovation Amid U.S. Restrictions

Investors are increasingly betting on Chinese companies to lead the global development of artificial intelligence, highlighting China's growing influence in the tech industry.

All articles tagged with #global market

Investors are increasingly betting on Chinese companies to lead the global development of artificial intelligence, highlighting China's growing influence in the tech industry.

Global EV sales reached a record 2.1 million in September 2025, driven by US, Europe, and China, with the US rushing to buy before tax credits expired, Europe benefiting from new incentives, and China maintaining its dominance with strong sales. Year-to-date, EV sales are up 26% worldwide, totaling 14.7 million.

A massive gold deposit valued at $83 billion has been discovered in Pingjiang County, Hunan Province, China, marking it as the world's largest known gold reserve. The deposit contains an estimated 1,000 metric tons of high-quality gold ore, significantly surpassing previous records. This discovery is expected to bolster China's position in the global gold market, potentially influencing gold prices and supply dynamics worldwide. The find challenges assumptions about the limits of gold mining and suggests further exploration could reveal even more resources.

Under a second Trump presidency, the oil market faces uncertainty as increased U.S. oil production could lower prices, while potential sanctions on Iran and Venezuela might tighten global supply and raise prices. Trump's policies may also lead to trade tensions, affecting global economic growth and oil demand. Despite the U.S. being the world's largest oil producer, the market outlook remains mixed, with some experts predicting lower prices due to increased supply, while others foresee higher prices due to geopolitical factors.

According to IDC's report, Samsung has reclaimed the top spot in the global smartphone market from Apple in Q1 of 2024, with a 7.8% increase in the overall market. While Samsung's sales were slightly down compared to the same quarter last year, Apple experienced a nearly 10% decrease. Xiaomi also saw a significant increase in sales, while Transsion nearly doubled its results in Q1.

Taiwan Semiconductor Manufacturing Co. (TSMC) experienced its fastest quarterly revenue growth in over a year, driven by the global demand for high-end chips and servers used in AI development. The company's sales surged 16% in the March quarter, surpassing expectations and indicating a strong outlook for the year. TSMC's focus on AI chips for companies like Nvidia and its expansion plans in the US, Japan, and Germany reflect the growing market for advanced semiconductor technology, despite concerns about sustained demand and geopolitical tensions.

Changing climate patterns in West Africa are affecting cocoa supplies, leading to higher prices for chocolate products. While African cocoa farmers struggle with lower yields and higher production costs, major confectionery companies are seeing increased profits by passing on the rise in cocoa prices to consumers. The high Easter demand for chocolate is expected to result in price spikes, with some popular brands already raising prices by up to 15%. Authorities are promoting farming education and promising support to help mitigate the effects of climate change on cocoa production. Despite rising candy prices, consumer spending on chocolate for Easter is expected to remain high, but smaller chocolate businesses are finding it difficult to keep up with the spike in cocoa prices.

Chinese electric vehicle maker BYD reported record earnings of US$4.16 billion for 2023, driven by strong EV deliveries and cost-cutting measures. The company cautioned about weak consumer demand and global headwinds despite its robust growth. BYD's revenue surged 42% to 602.3 billion yuan, fueled by record deliveries of new energy vehicles (NEVs). The company aims to strengthen R&D, enhance product competitiveness, and expand overseas to lead the global NEV market. Despite a sequential slowdown in profitability in the final quarter of 2023, BYD remains a dominant force in the Chinese EV market, facing stiff competition and a price war.

China's LONGi Group, the world's largest solar panel maker, is set to lay off up to 30% of its workforce to streamline operations and cut costs amid fierce competition and plummeting solar panel prices. The company disputes the 30% figure, stating that job reductions will amount to around 5% of its workforce. The global solar market is experiencing a glut of panels, leading to intense competition and forcing companies to sell at or below production costs. Despite the challenges, China's solar industry may see a rebound by year-end, with a projected rise in margins in 2025 due to consolidation and a better balance between supply and demand.

Major African cocoa plants in Ivory Coast and Ghana have stopped or cut processing due to the inability to afford buying beans, leading to a global chocolate price surge. With cocoa prices doubling over the last year and a fourth year of poor harvests expected, consumers are likely to pay more for chocolate. The market faces a deficit, with processors struggling to buy beans and supply less butter at higher prices to chocolate-makers. This disruption has led to a breakdown in the established cocoa trade mechanism, causing a shortage of beans for local processors and global traders.

China's exports surged by 7.1% in the first two months of 2024, surpassing expectations and indicating a positive start to the year despite challenges such as subdued overseas demand and geopolitical tensions. Imports also saw a growth of 3.5%, beating market expectations. The strong rebound is attributed to the global tech cycle recovery and lower destock pressure, with exports benefiting from the global tech cycle recovery and lower destock pressure. However, concerns remain about weak imports, reflecting challenging domestic demand conditions. China's total trade surplus stood at US$125.1 billion, and Premier Li Qiang vowed to bolster the trade sector, emphasizing support for international market expansion and cross-border e-commerce enterprises.

Qatar plans to expand its natural gas production from the world's largest gas field, the North Field, by boosting capacity to 142 million tonnes per annum by 2030, representing an 85 percent increase. The expansion, named North Field West, will add 16 million tonnes of liquefied natural gas (LNG) per year, with additional gas quantities estimated at 240 trillion cubic feet. This move comes amid increased global demand for LNG, particularly in light of Europe's need to replace Russian pipeline gas. Qatar's expansion plans follow recent long-term supply deals with India, Bangladesh, China, France, Britain, and Italy, and the country aims to continue appraising its gas reservoirs for further expansion based on market demand.

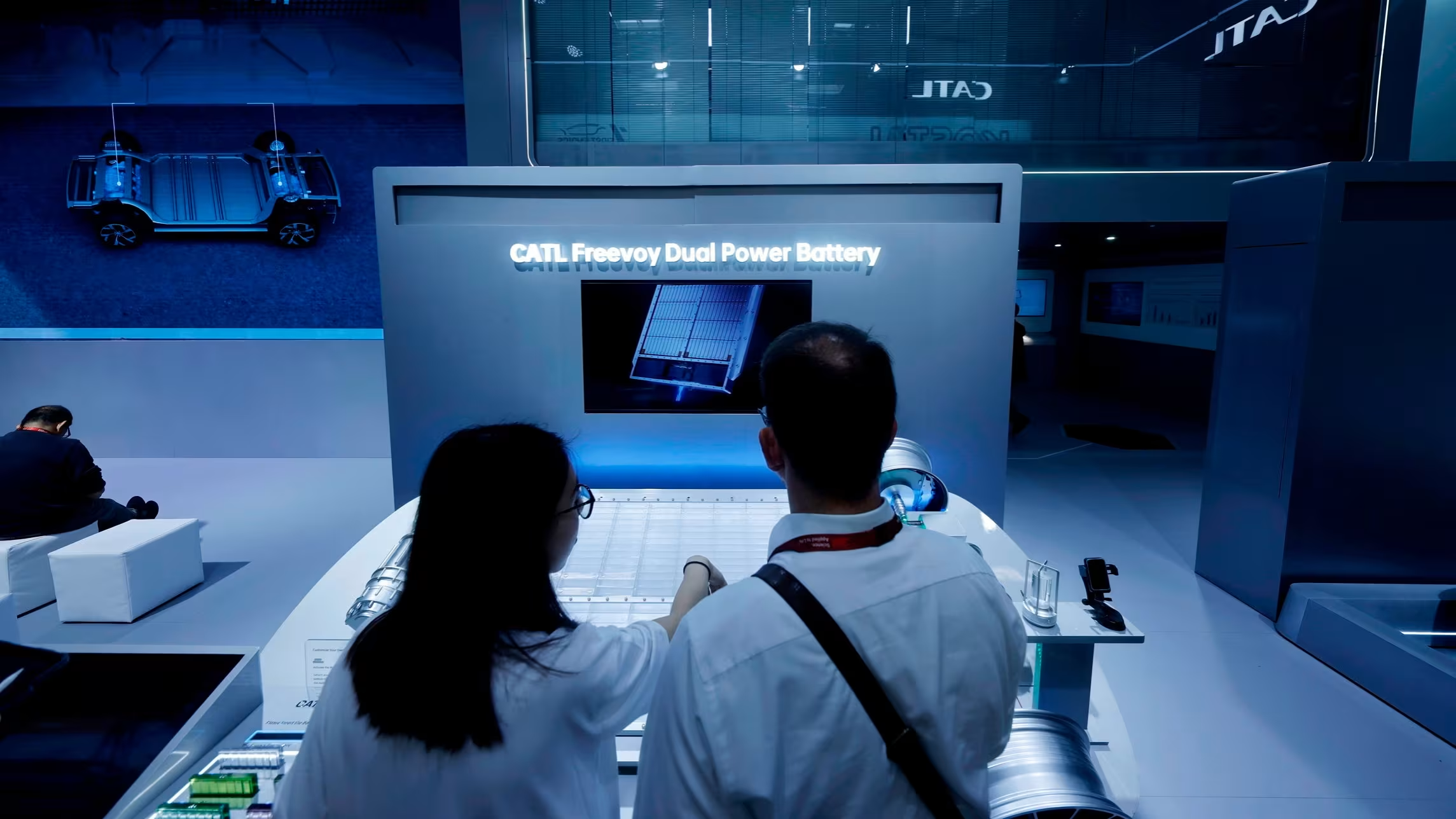

Chinese electric vehicle (EV) makers have rapidly grown to dominate the global EV market, posing a significant threat to US auto industry players like Tesla, GM, and Ford. With a wide range of affordable EV options and a strong focus on expanding into international markets, Chinese companies are challenging the traditional dominance of American automakers. As China aims to become the world's leading EV manufacturer, the US is grappling with how to protect its auto industry while also providing consumers with affordable EV choices. The competition between Chinese and US automakers is reshaping the global automotive landscape and raising questions about the future of the industry.

The natural gas market experienced a significant drop in prices due to increased production, decreased demand from mild winter conditions, and a pause on new natural gas projects by the Biden administration. The market also saw reduced activity in LNG export plants and operational setbacks at key plants. The forecast suggests that warmer weather will continue, maintaining reduced demand for heating gas, while high crude oil prices incentivize increased oil and associated gas extraction. Market participants will closely watch for updates or changes in the Biden administration’s approach to LNG projects, and international developments could indirectly impact U.S. LNG exports, influencing domestic gas prices.

Xiaomi's upcoming flagship smartphone, the Xiaomi 14 Ultra, is rumored to launch globally with a lower price tag than its predecessor, the Xiaomi 13 Ultra, despite featuring several hardware upgrades. This potential price reduction is speculated to be part of Xiaomi's restructuring of its global pricing strategy, aiming to introduce new premium devices to the global market. However, given the historical trend of increasing prices with each new generation, the likelihood of the Xiaomi 14 Ultra being cheaper remains uncertain.