Energy Markets News

The latest energy markets stories, summarized by AI

Featured Energy Markets Stories

Oil Prices Surge Amid OPEC+ Output Cuts and Mixed Demand Signals

WTI crude oil prices surged to $80 a barrel, marking the best session in over two months, driven by anticipated demand and supply constraints. Goldman Sachs revised its long-term oil demand forecast upward, predicting peak demand around 2034. Energy stocks rallied, with significant gains in the Energy Select Sector SPDR Fund. Goldman Sachs also highlighted key energy stocks to buy and sell based on free cash flow, growth assets, and refining market exposure.

More Top Stories

More Energy Markets Stories

"Oil Prices Plummet as US Stockpiles Reach 10-Month High, Impacting Market Analysis"

Oil prices experienced a significant drop due to conflicting signals, including increased stockpiles and geopolitical tensions, with global benchmark Brent trading below $88 a barrel and US crude inventories reaching their highest level since last June.

"Oil Traders Brace for $250 Price as Iran-Israel Conflict Escalates"

Oil prices fell over 3% as the market discounted the risk of a wider war between Israel and Iran, with the possibility of a Gaza ceasefire easing geopolitical concerns. The stronger dollar and weakening U.S. gasoline demand also contributed to the decline. Despite ongoing tensions, there has been no supply disruption, and analysts believe that Israel is unlikely to target Iran's oil facilities in response. Iranian President Ebrahim Raisi warned of a "massive and harsh" response to any Israeli counterattack, while U.K. Foreign Secretary David Cameron urged restraint.

"Market Speculation: Oil Prices Surge Amid Middle East Tensions"

Oil traders are making significant bets on $250 oil, with record levels of bullish options amid geopolitical tensions between Israel and Iran. Despite trading down on Tuesday due to the U.S. Federal Reserve's monetary policy and additional sanctions on Iran, oil prices remain near $90 per barrel for Brent crude. The market is now awaiting Israel's response to Iran's attack to determine the risk premium for crude oil.

"Market Reaction: Iran's Attack and the Impact on Oil, Gold, and Dow Futures"

Oil prices fell after Iran's weekend attack on Israel, as the market had already factored in the risk premium. The attack caused limited damage, leading to uncertainty over Israel's response. Analysts believe that any significant and longer-lasting price effects would require a material disruption to oil supply, such as constraints on shipping in the Strait of Hormuz near Iran. The conflict could still be contained to Israel, Iran, and its proxies, with possible involvement of the U.S., and any de-escalation could see prices falling back quite sharply.

"Oil Market Reacts to Iranian Strike on Israel, Potential for 'Super Spike' in Prices"

The oil market has shown resilience in the face of concerns about a broader conflict following an Iranian strike on Israel, with prices remaining stable. Despite the geopolitical tensions, the market has not experienced significant disruptions, indicating a muted reaction to the incident.

"Oil Prices Dip as Middle East Tensions Ease and Ceasefire Talks Progress"

Oil prices dropped nearly 2% as tensions in the Middle East eased following Israel's withdrawal of soldiers from southern Gaza and commitment to ceasefire talks, prompting Brent crude to fall below $90 a barrel. The move came after concerns of supply disruption had driven up oil prices by more than 4% the previous week. Meanwhile, Saudi Arabia raised official selling prices for crude grades to Asia, and a fire struck an offshore platform operated by Mexico's national oil company Pemex. Despite solid demand and no further geopolitical hits to oil supply, Goldman Sachs analysts expect Brent to remain below $100 a barrel, while investors await U.S. and China consumer price index data for clues on possible Fed rate cuts and economic health.

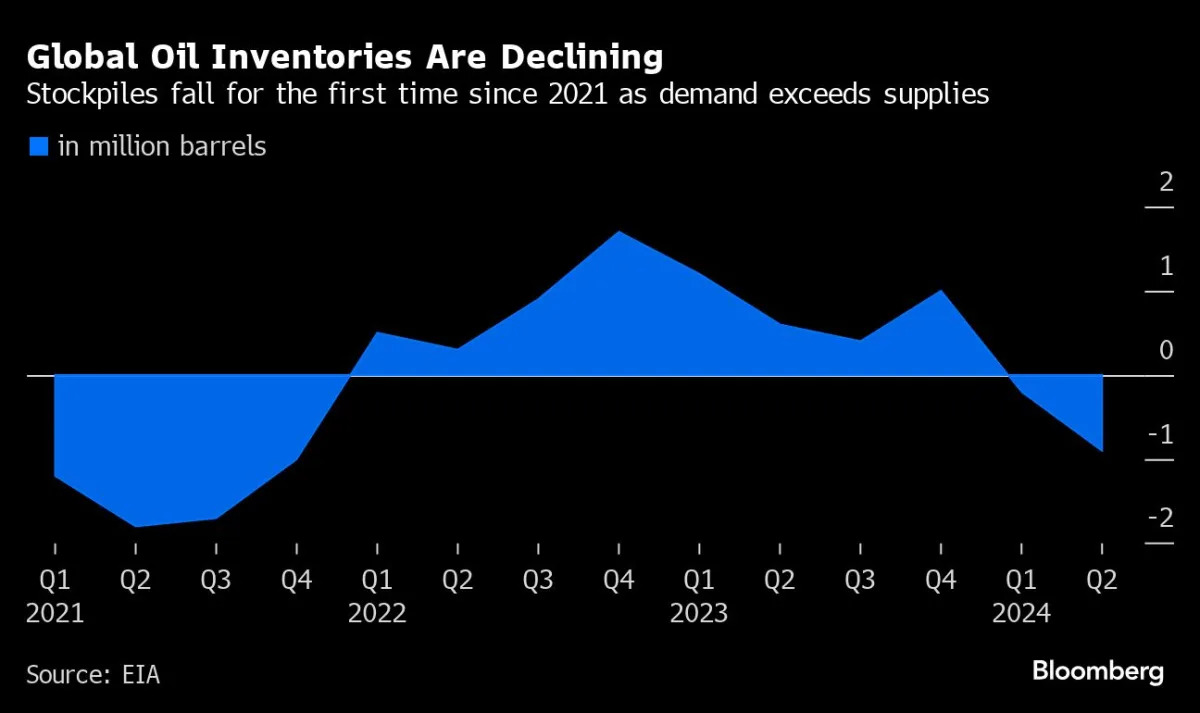

"Global Shortage Threatens to Push Oil Prices to $100 This Summer"

Oil prices surged above $90 a barrel due to military tensions and global supply shocks, including Mexico's cut in crude exports, US refiners consuming more domestic barrels, stranded Russian cargoes, potential Venezuelan supply disruptions, and Houthi rebel attacks delaying crude shipments. Despite the turmoil, OPEC and its allies are maintaining production cuts, intensifying fears of a commodity-driven inflation resurgence and raising the possibility of oil prices reaching $100 this summer.

"Geopolitical Tensions Propel Oil Prices to New Highs"

Global supply shocks, including Mexico's crude export cuts, US sanctions on Russian and Venezuelan oil, and Houthi rebel attacks on tankers, are intensifying fears of commodity-driven inflation and pushing oil prices towards $100 a barrel. The disruptions, combined with healthy global demand, are turbocharging an oil rally ahead of the US summer driving season, complicating central banks' rate-cut deliberations and clouding US President Joe Biden’s reelection chances. The surge in oil prices is also snarling the Biden administration’s plans to refill emergency US oil reserves and threatening to push retail gasoline prices higher, contributing to concerns about a reversal in the recent slowdown in consumer price gains.

"Oil Prices Surge as Tensions Drive Market to New Highs"

Geopolitical tensions in the Middle East have driven crude oil futures to a five-month high, with WTI crude rallying to $86.76 per barrel and Brent May futures rising to $90.98. Despite the rally, Wall Street remains cautious about the oil price outlook, with analysts' Q2 Brent forecast of USD 94/bbl currently the only forecast above USD 90/bbl among 34 Wall Street forecasts. However, some analysts believe that oil fundamentals remain strong, and further price gains are expected in Q2-2024. Energy stocks have garnered momentum, with Morgan Stanley upgrading the sector to overweight from neutral, noting that energy companies have lagged the performance of oil and are favorably valued.

"Middle East Crisis Drives Oil Prices to Yearly Highs"

Crude oil prices surged to their highest levels since October, with WTI crude briefly surpassing $85 per barrel and Brent crude rising above $88 per barrel. This rise is attributed to tensions in the Middle East, drone attacks on Russian refineries, and expectations of OPEC+ maintaining production cuts. Analysts predict Brent crude reaching $100 per barrel by September, with energy stocks outperforming the S&P 500 amid the broader stock market sell-off. The energy sector's 14% gain this year surpasses the S&P 500's 9% increase, with oil- and gas-related equities leading the S&P 500 last month.