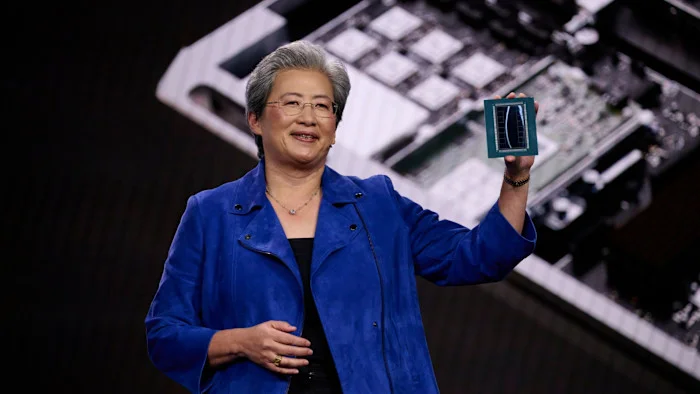

Meta taps AMD for a colossal AI‑chip pact: 6GW, $100B+ value, with a path to a 10% stake

Meta is pursuing a massive AI-chip supply deal with AMD that targets about 6 gigawatts of compute, potentially exceeding $100 billion in value, with a pathway for AMD to hold up to a 10% stake in the venture.