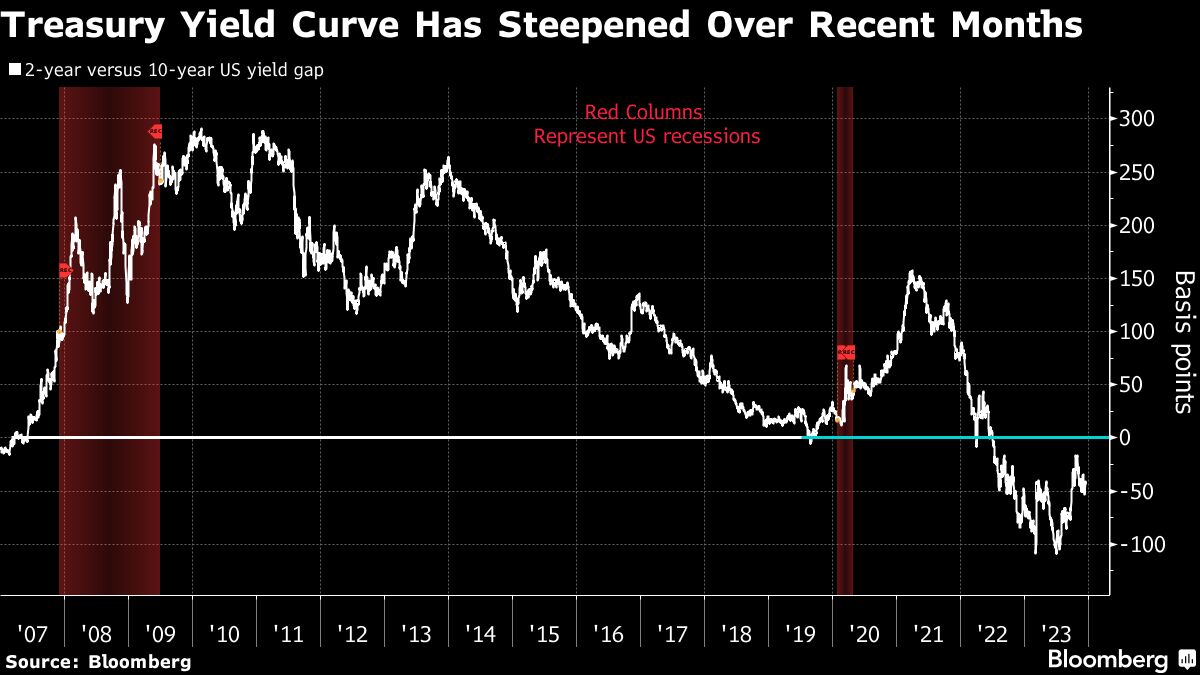

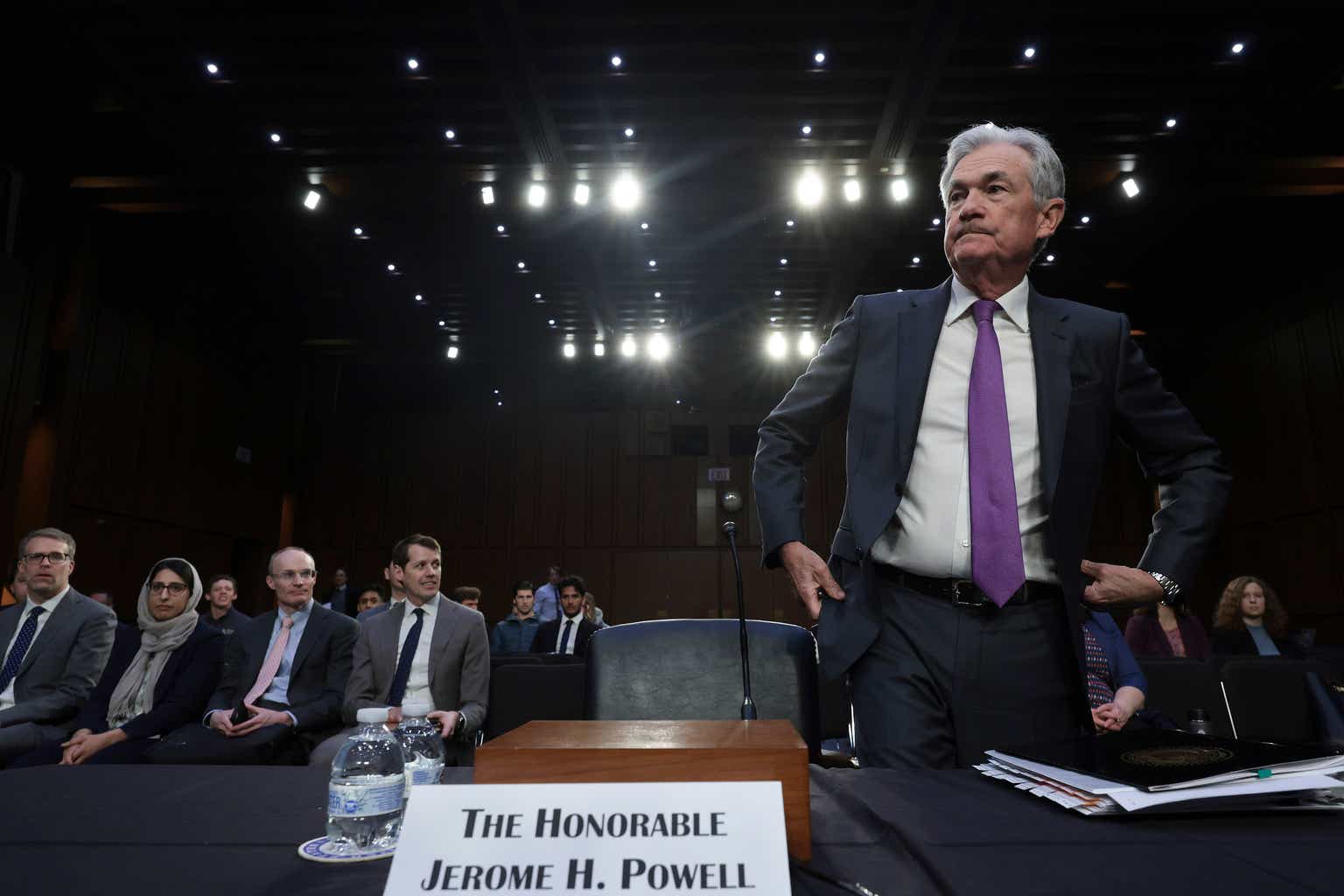

Fed's Rate Cut Sparks Bond Market Volatility and Yield Curve Steepening

Longer-term Treasury yields and mortgage rates increased following a Fed rate cut, with the bond market reacting more to inflation expectations and bond supply than to the policy rate itself. The 10-year Treasury yield rose to 4.14%, and mortgage rates jumped to 6.35%, reflecting concerns about inflation and bond supply issues, while the yield curve steepened, indicating market anxiety about future economic conditions.