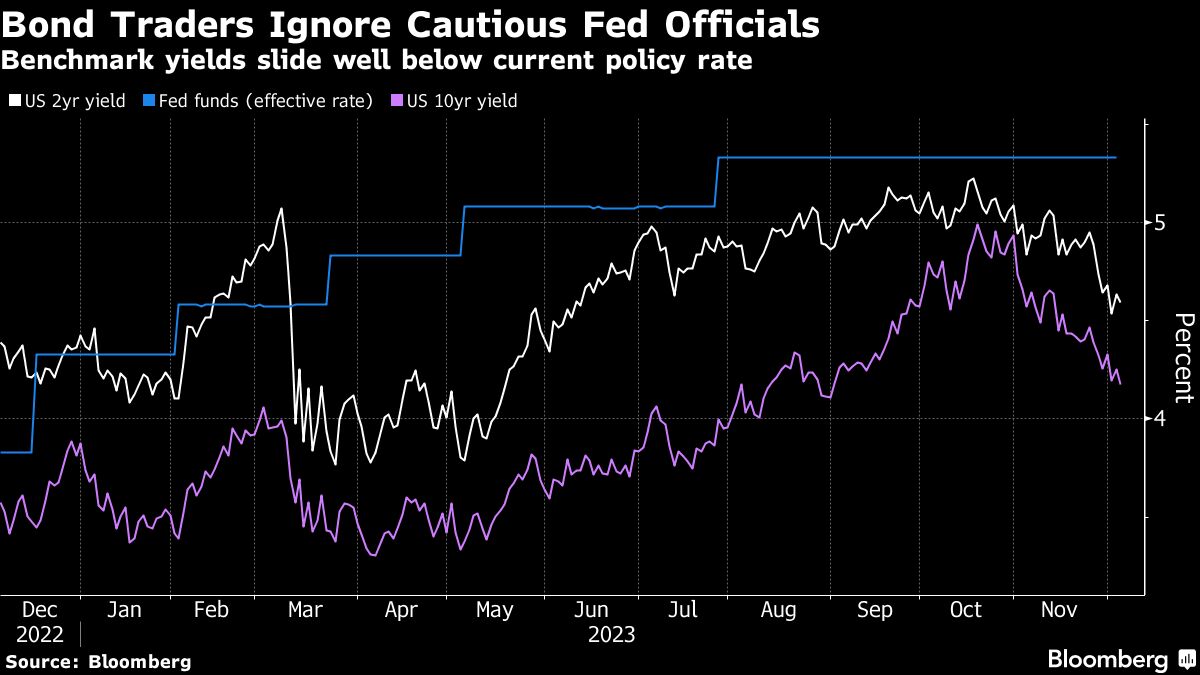

"Market Watch: Bond Traders Brace for 5% Yield Amid Inflation Data Surge"

Bond traders are preparing for the possibility of 10-year US Treasury yields exceeding 5% amid increasing chances of the Federal Reserve not cutting rates this year, with Schroders Plc shorting US bonds and Pacific Investment Management Co. expecting a more gradual pace of policy easing, and a "non-negligible" chance of no rate cuts at all.