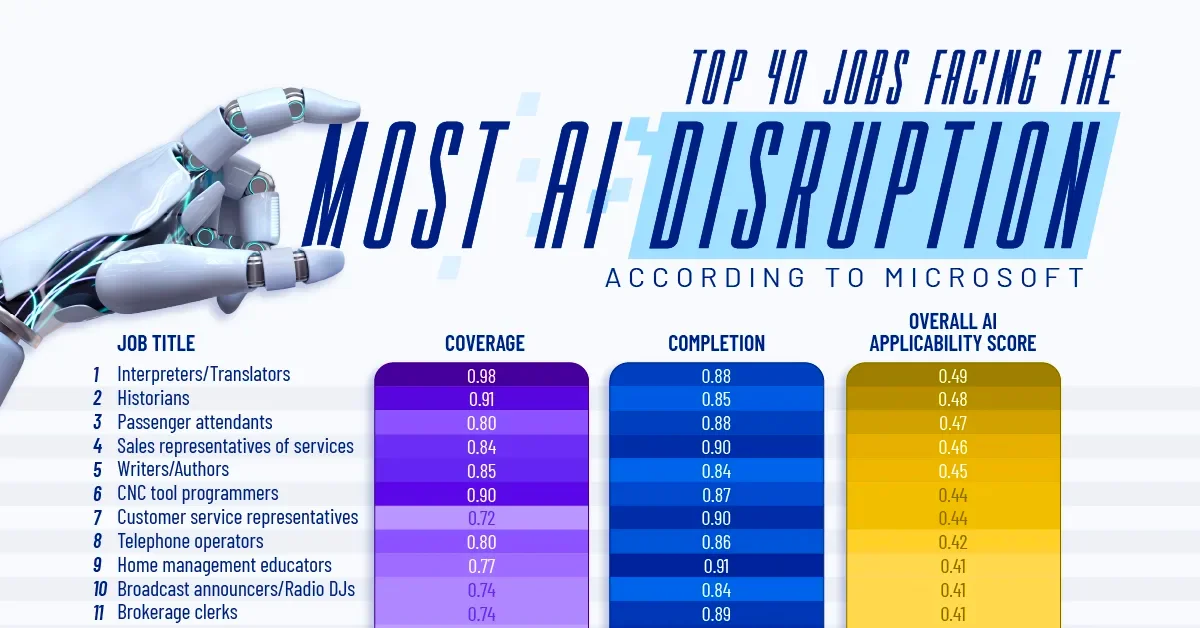

AI Job Wipeout Fears Could Ripple Into Blue-Collar Work

A Citrini Research scenario warns that AI-driven productivity gains could displace white-collar workers, pushing some into blue-collar roles and stressing the broader labor market, though economists criticize the scenario as extreme and potentially exaggerated.