Wall Street's Shift to Short-Dated Debt Amidst the Fed's Pivot

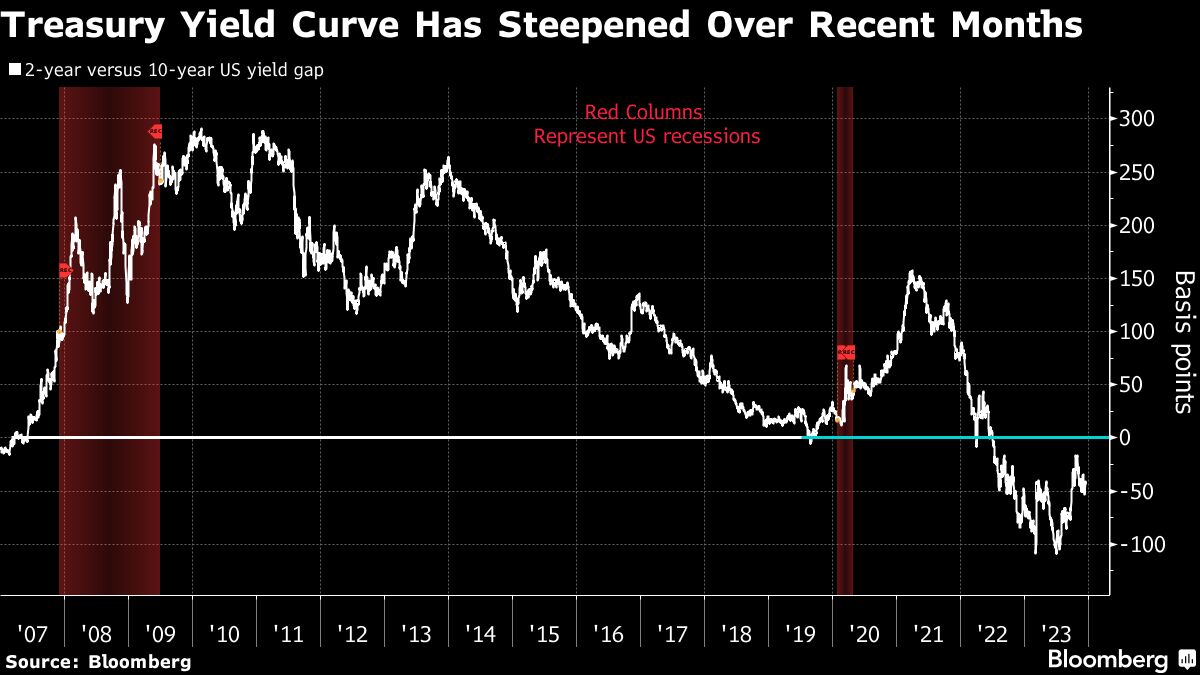

Wall Street is turning to short-dated debt as the best way to trade the Federal Reserve's pivot towards monetary easing. With the Fed expected to lower rates and support a soft landing, investors are loading up on shorter maturity debt that still provides a yield of over 4%. This sentiment is driven by the fear that rates on cash-like investments could soon plunge, prompting investors to move into Treasury notes. Additionally, there is a consensus that the economy may avoid a recession, leading to a lack of appetite for longer-term securities. The two-year Treasury is seen as the sweet spot on the yield curve, offering an attractive yield higher than any other maturity.

Reading Insights

0

6

5 min

vs 6 min read

89%

1,072 → 113 words

Want the full story? Read the original article

Read on Yahoo Finance