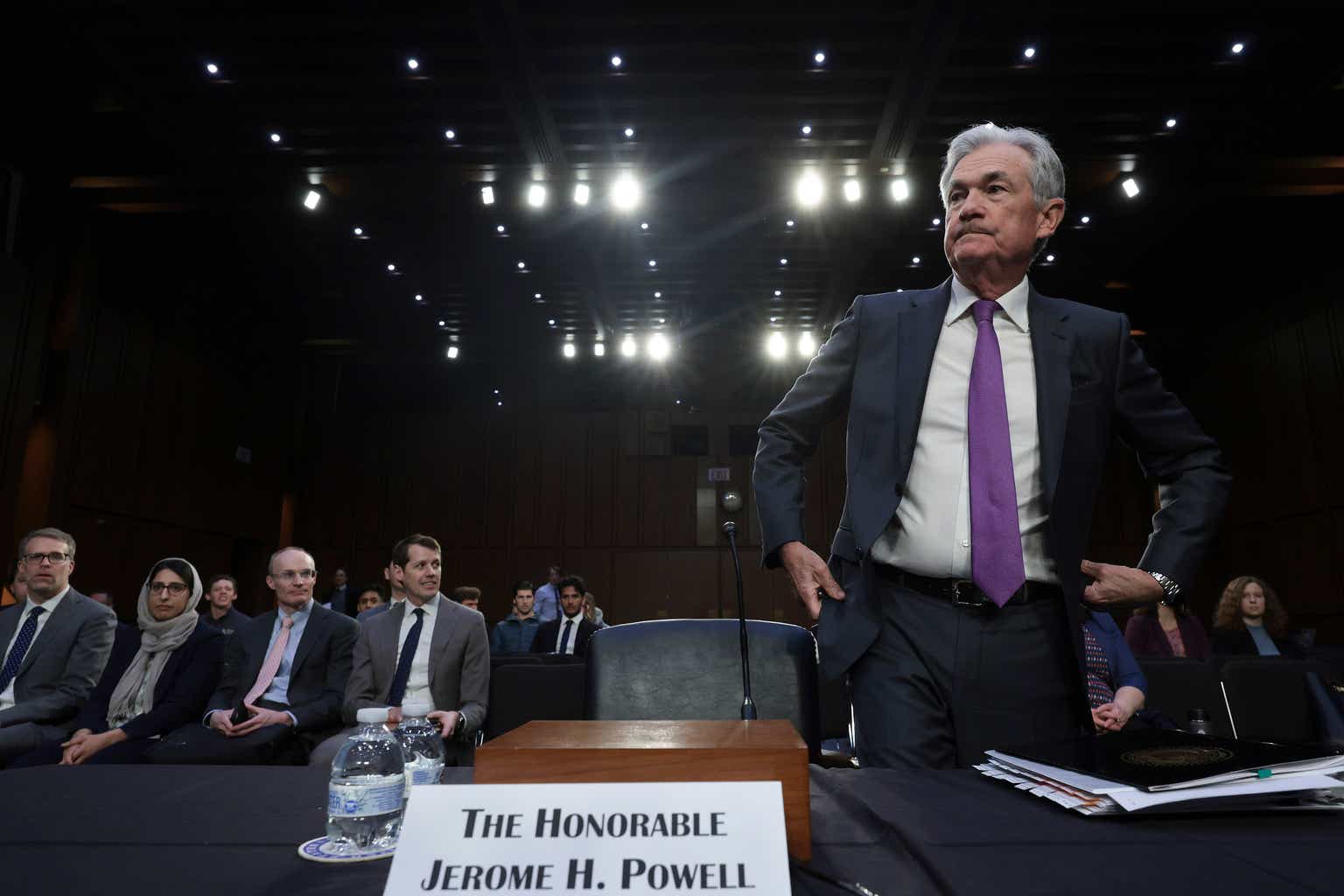

The Fed's Misleading Message: Markets Brace for Powell's Speech

TL;DR Summary

The Federal Reserve's projection of three rate cuts for 2024 is not an attempt to stimulate the economy but rather a response to projected lower inflation rates. The Fed believes that financial conditions will naturally adjust and tighten as the economy weakens. The bond market is also indicating a potential slowdown in the economy, as the yield curve is expected to steepen. The Fed's message suggests that it is confident in the progress of inflation and expects economic data to support its projected policy direction.

- The Fed's Message To The Market Isn't What It Seems Seeking Alpha

- Surveillance: 'Awkward' Fed Readies a Message That Markets Won't Believe Bloomberg

- Markets are declaring victory over inflation for Powell, and that has some economists worried MarketWatch

- On My Mind: Miracle on 20th Street | Franklin Templeton Beyond Bulls & Bears

- Get ready for Powell to 'stay the course' in Wednesday speech: Jay Woods Fox Business

Reading Insights

Total Reads

0

Unique Readers

7

Time Saved

9 min

vs 10 min read

Condensed

96%

1,930 → 85 words

Want the full story? Read the original article

Read on Seeking Alpha