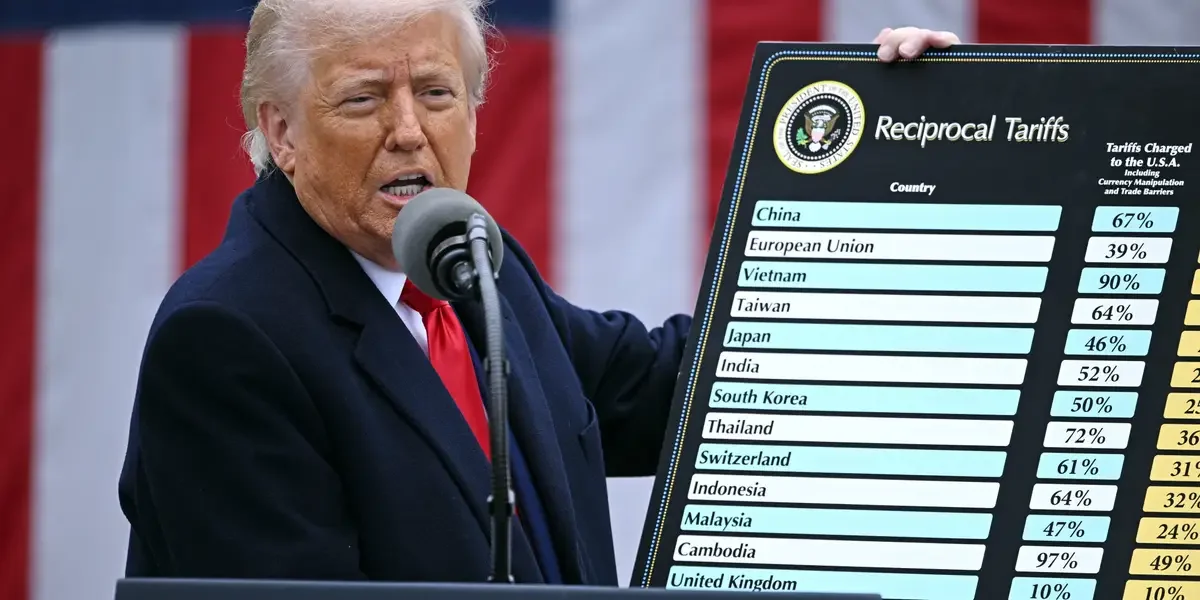

PolitiFact flags mixed truth in Trump's SOTU on inflation, borders and crime

PolitiFact’s fact-check of Trump’s State of the Union finds a mix of truth and exaggeration: inflation isn’t “plummeting” — it’s eased to about 2.4% year over year as of January 2026; gas prices aren’t nationwide below $2.30 a gallon; TrumpRx.gov savings are overstated. The claim that zero illegal aliens were admitted in nine months is misleading given a sharp drop in encounters and ongoing removals. There’s no solid evidence that a sea-based military campaign has halted drugs; and the 2025 murder-rate decline is likely among the largest in decades but not definitively the lowest in 125 years due to data caveats. The SNAP note refers to projected benefit losses under a work-requirements law, not an immediate universal relief.