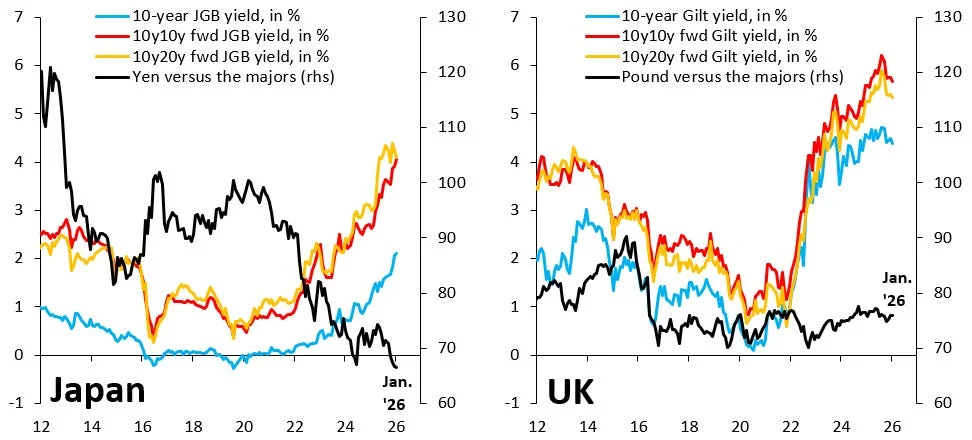

US Tries to Repress Long-Term Yields as Yen Turmoil Roils Markets

US policymakers deploy jawboning, a yen-rate check, and MBS buybacks to push down the 10-year yield and mortgage rates amid global bond-market stress linked to Japan’s turmoil; while these tactics provide a temporary pullback, inflation, deficits, and debt burdens suggest underlying risks remain and market volatility could persist.