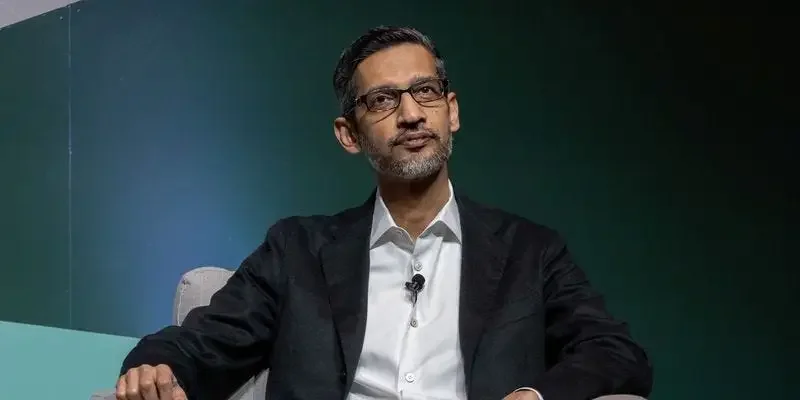

Ledn taps Bitcoin-Backed Bonds for $188 Million Offering

Ledn sold $188 million in bonds secured by bitcoin, with Jefferies as structuring agent and bookrunner. The two-tranche deal is backed by 4,078.87 BTC (about $357 million) and includes an investment-grade tranche priced at 335 basis points over the benchmark rate, and carries a BBB- rating, signaling growing demand for bitcoin-backed credit.