Japan's Yen at a Crossroads: Debt, Yields, and the Asset Sell-off Option

TL;DR Summary

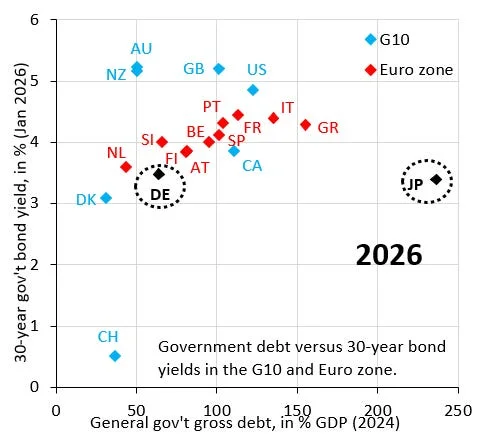

Japan's yen is weakening as markets demand higher interest rates, but raising rates risks a fiscal crisis given gross debt around 240% of GDP while net debt is about 130%. Official FX intervention is unlikely to stop the slide; the more viable path is to reduce gross debt by selling government assets, which could ease depreciation, though illiquid assets and policy risks complicate any such move.

- Japan in Crisis Robin J Brooks | Substack

- The Takaichi Fallout: The high-risk gamble of "Takaichi-cost" news.cgtn.com

- Japan’s yen is in free fall. US investors should take notice. MSN

- Japanese shares mark record-high close; bonds, yen drop on stimulus speculation marketscreener.com

Reading Insights

Total Reads

0

Unique Readers

7

Time Saved

2 min

vs 3 min read

Condensed

88%

553 → 66 words

Want the full story? Read the original article

Read on Robin J Brooks | Substack