G10 debt strains: higher yields, currency wobble

TL;DR Summary

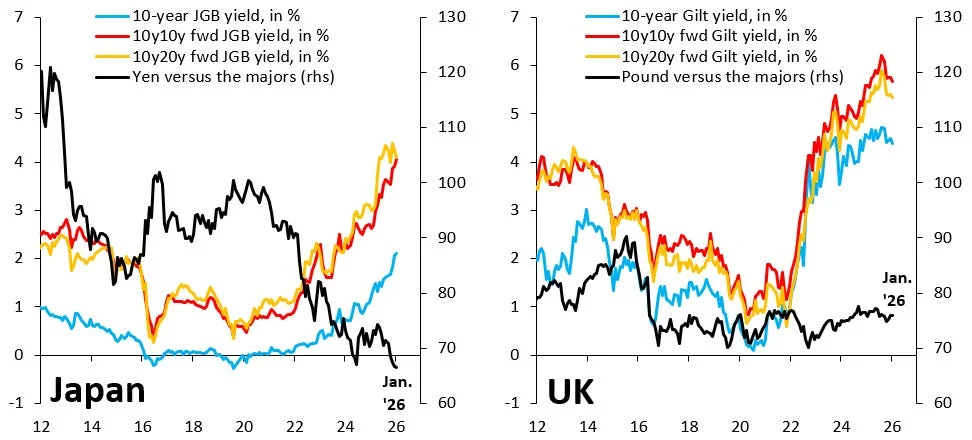

The article argues that debt crises in advanced economies are more plausible than commonly thought: high public debt plus shocks can push yields higher, and even when central banks cap yields, currencies can depreciate, signaling ongoing, low‑grade crises across Japan, the UK, and parts of the euro area. For example, Japan’s yen falls as JGB yields rise despite BoJ caps, the UK sees rising gilt yields with a relatively stable pound, and Italy, Spain and France face growing debt pressures within a euro framework, though Germany's low debt provides some insulation. The piece concludes that debt distress is already unfolding in the G10 and could deepen.

What does a debt crisis look like in the G10? Robin J Brooks | SubstackView Full Coverage on Google News

Reading Insights

Total Reads

0

Unique Readers

5

Time Saved

3 min

vs 4 min read

Condensed

86%

738 → 106 words

Want the full story? Read the original article

Read on Robin J Brooks | Substack