Nvidia Bets on Compute as AI Spend Fuels Data-Center Growth

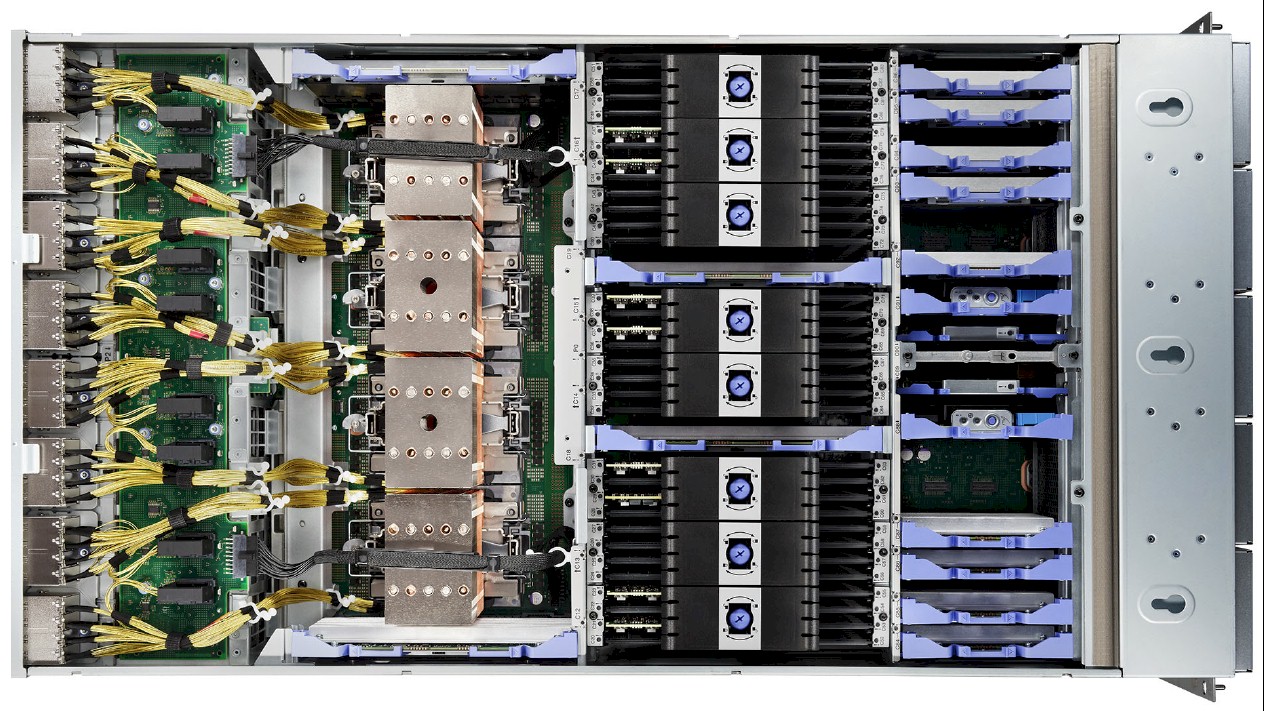

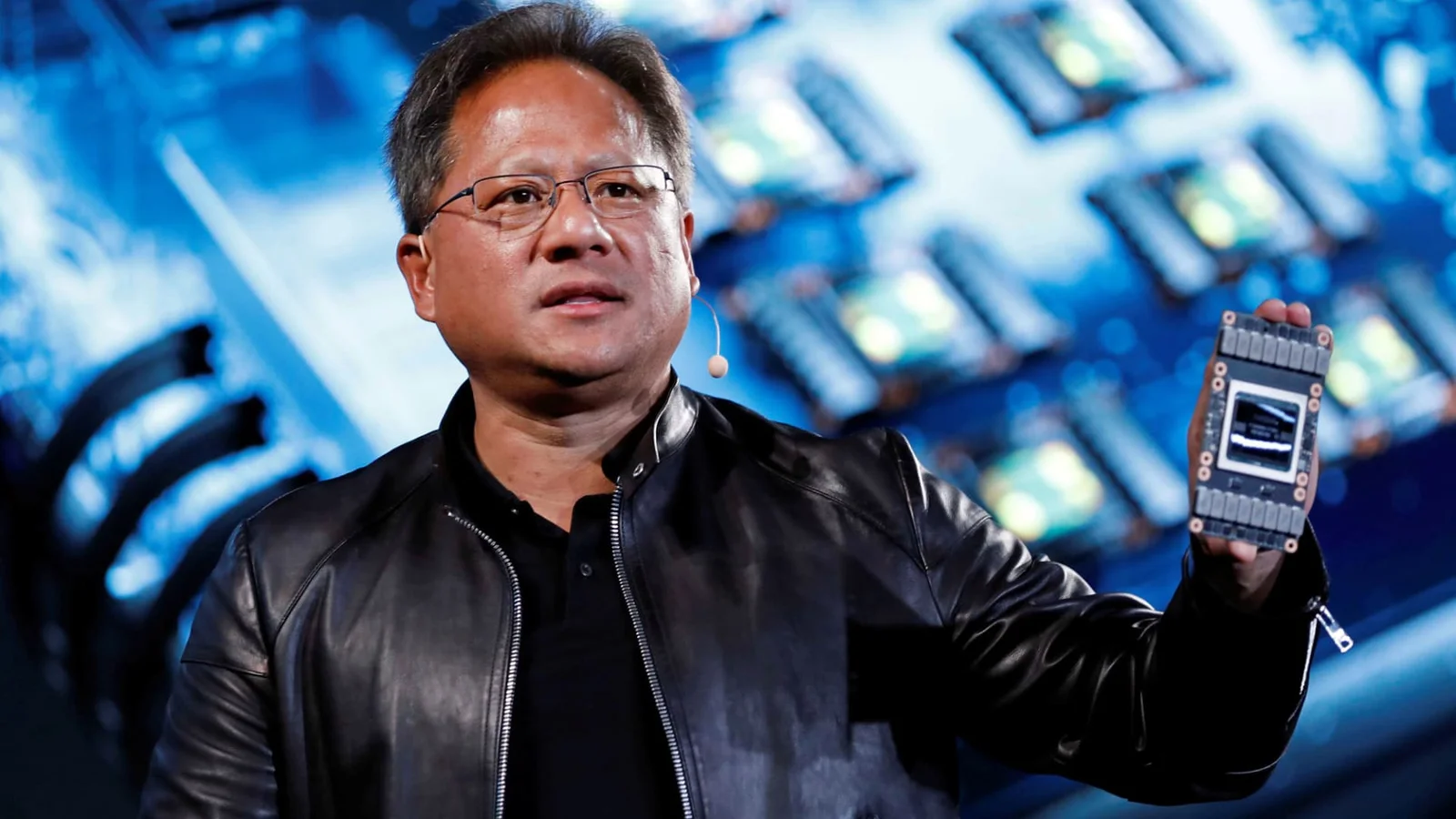

Nvidia reported strong earnings, led by a data-center unit that grew about 68% year over year to roughly $193.7 billion in revenue, underscoring how AI-related capex from hyperscalers is fueling demand for compute. CEO Jensen Huang said compute equals revenue and that token growth will sustain demand, but investors remain cautious about enterprise AI adoption, the OpenAI partnership, and whether chip shipments to China will materialize.