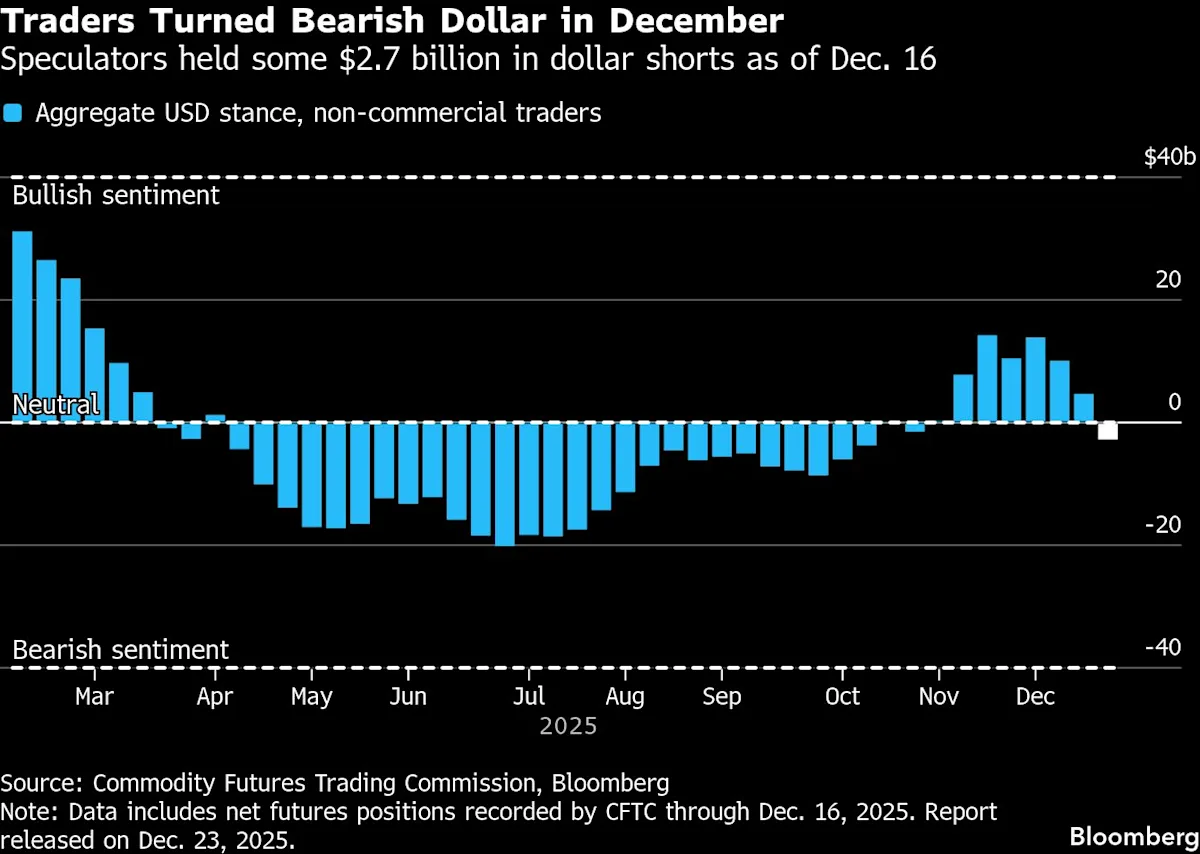

Stable dollar urged as U.S. debt nears $40 trillion, says former Fed president

With U.S. debt approaching $40 trillion, former Dallas Fed President Robert Kaplan argues currency stability matters more than gains from a weaker dollar; the piece notes Trump’s praise of the dollar’s decline, the dollar’s reserve-status, and how debt levels shape Treasury demand amid shifting market sentiment.