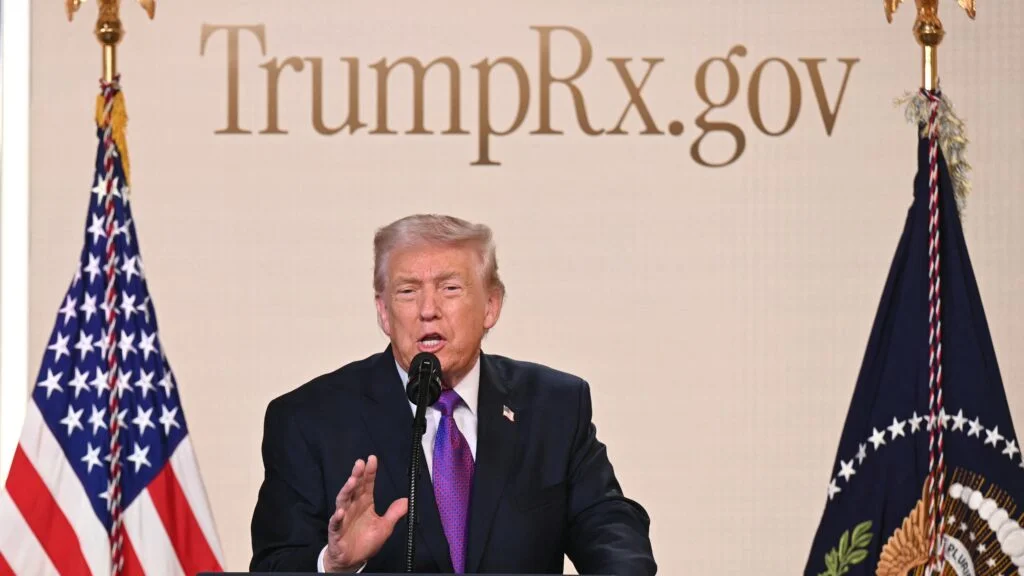

Merck reshapes structure to create dedicated cancer unit led by Keytruda

Merck will split its human-health business into two units: a cancer-focused division led by Keytruda and a separate non-oncology medicines arm, as the company diversifies ahead of Keytruda’s looming loss of exclusivity. Keytruda remains the world’s top-selling drug, with more than $30 billion in revenue in 2025, accounting for about half of Merck’s total revenue. Shares rose about 1.4% in premarket trading. Merck has expanded its pipeline and made major acquisitions to bolster growth, and appointed Jannie Oosthuizen to lead the new cancer unit.