Healthcare And Pharmaceuticals News

The latest healthcare and pharmaceuticals stories, summarized by AI

Featured Healthcare And Pharmaceuticals Stories

Trump weighs veto on ACA subsidy extension, fueling Obamacare uncertainty

President Donald Trump said he might veto a Democratic-backed bill to restore federal health-insurance subsidies under the Affordable Care Act, injecting uncertainty into a partisan fight as subsidies expire at the end of 2025 and Americans face an enrollment deadline of January 15 (with potential extension).

More Top Stories

Viking Therapeutics' Weight-Loss Drug Trial Results Double Stock

Quartz•2 years ago

More Healthcare And Pharmaceuticals Stories

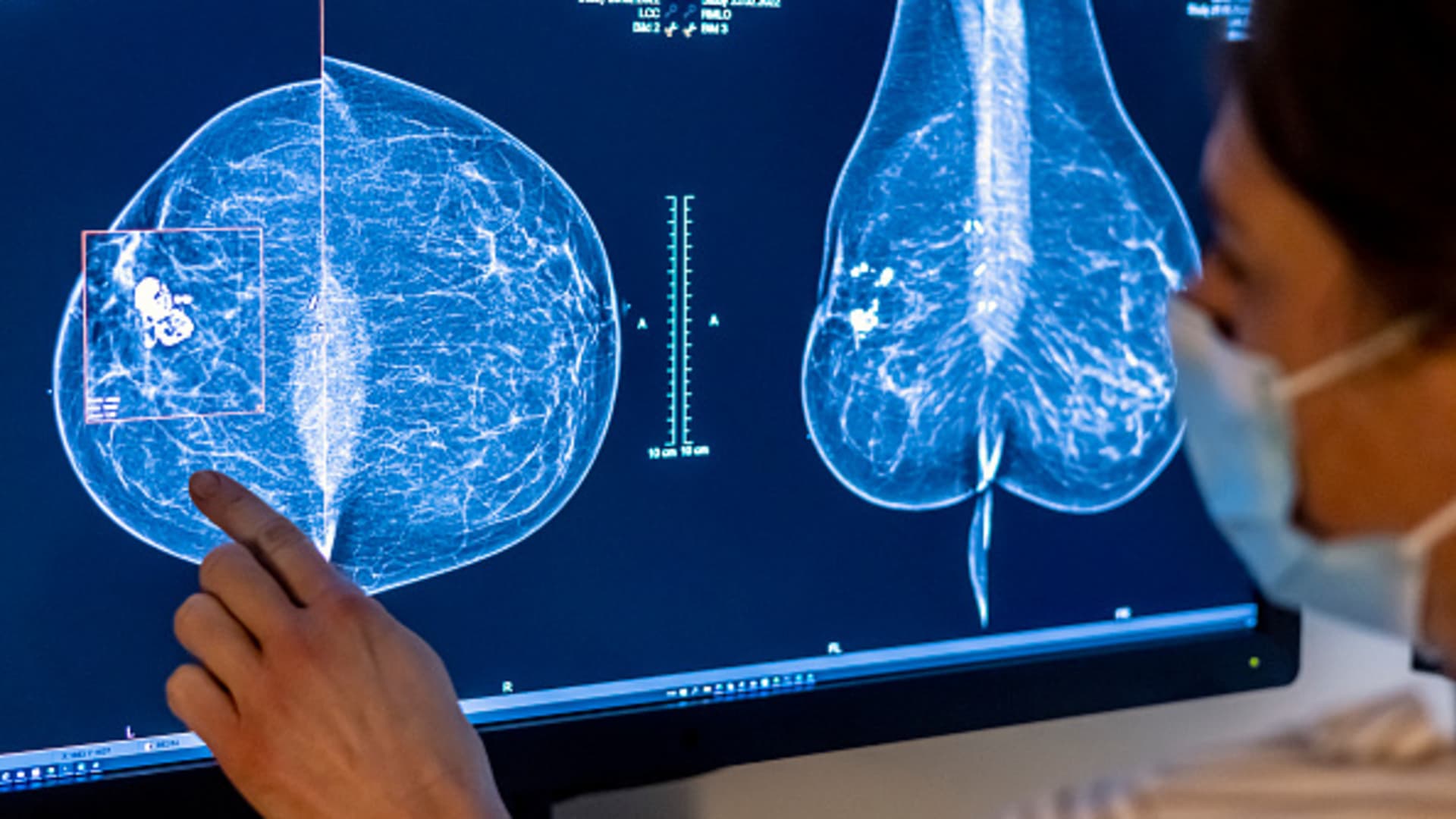

"Biotech and Pharma Companies Pin Hopes on Promising Cancer Drugs for Growth"

Biotech and pharmaceutical companies are increasingly focusing on antibody-drug conjugates (ADCs) as a promising class of cancer drugs to drive growth, with Johnson & Johnson, Pfizer, and Merck making significant investments in ADCs. The recent rise of ADCs is attributed to advancements in technology, increased confidence in their potential, and the potential for longer market exclusivity. The market for ADCs is expected to continue growing, with estimates suggesting they could account for a significant portion of the worldwide cancer market by 2028. Companies are betting on ADCs to fuel growth and establish themselves as leaders in cancer treatment, with Pfizer's acquisition of Seagen and Merck's licensing agreement with Daiichi Sankyo being notable examples of this trend.

"GSK's $1.4 Billion Deal to Acquire Aiolos Bio Strengthens Respiratory Portfolio"

GSK has entered into an agreement to acquire Aiolos Bio for $1 billion upfront and up to $400 million in milestone payments, gaining access to AIO-001, a potentially best-in-class, long-acting anti-thymic stromal lymphopoietin (TSLP) monoclonal antibody. This acquisition expands GSK’s respiratory pipeline and offers the potential to redefine the standard-of-care for asthma treatment, with AIO-001 targeting the TSLP pathway and demonstrating initial safety and tolerability in early studies. The transaction is subject to regulatory clearances and underscores GSK’s commitment to advancing respiratory therapies.

"J&J's $2 Billion Acquisition of Ambrx Biopharma Signals Major Advances in Cancer Treatment"

Johnson & Johnson and Merck kick off a major U.S. healthcare conference by announcing plans to acquire cancer therapy developers, with combined deals worth over $6 billion, signaling a strong start for M&A in 2024. J&J is set to buy Ambrx Biopharma for $2 billion to gain targeted cancer therapies, while Merck plans to acquire Harpoon Therapeutics for about $680 million to access early-stage immunotherapies for lung cancer and multiple myeloma. Additionally, medical device maker Boston Scientific is entering the market with a $3.7 billion deal for Axonics Inc, reflecting a return to business as usual in the pharmaceutical industry after the challenges of 2023.

Johnson & Johnson's $2 Billion Acquisition of Cancer Drug Developer Ambrx Biopharma

Johnson & Johnson has announced its $2 billion acquisition of Ambrx Biopharma, a company specializing in cancer treatment through antibody-drug conjugates (ADCs). This move reflects J&J's strategy to fill a revenue gap expected in 2025 and follows similar investments by other major pharmaceutical companies. The acquisition is expected to enhance J&J's oncology pipeline and provide opportunities for precision biologics in cancer treatment.

Johnson & Johnson's $2 Billion Acquisition of Ambrx Signals Major Move in Cancer Treatment

Johnson & Johnson has made a $2 billion cash deal to acquire Ambrx Biopharma, joining other major pharmaceutical companies in a spree of acquisitions focused on antibody-drug conjugates in the oncology sector. This move comes as the industry anticipates increased spending to bolster pipelines ahead of looming patent expirations at the end of the decade.