Novo Nordisk bets $2.1B on next-gen oral biologics with Vivtex

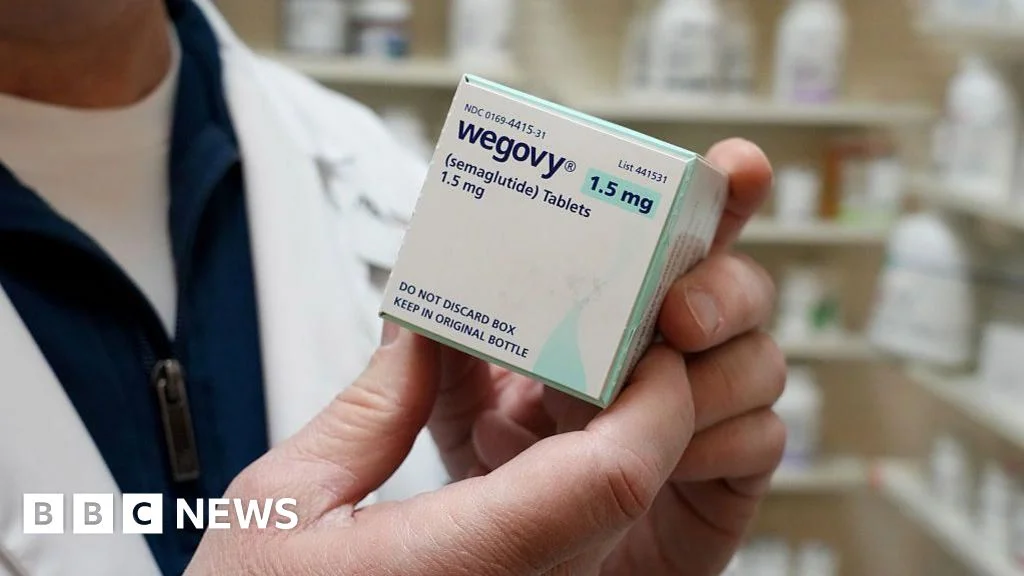

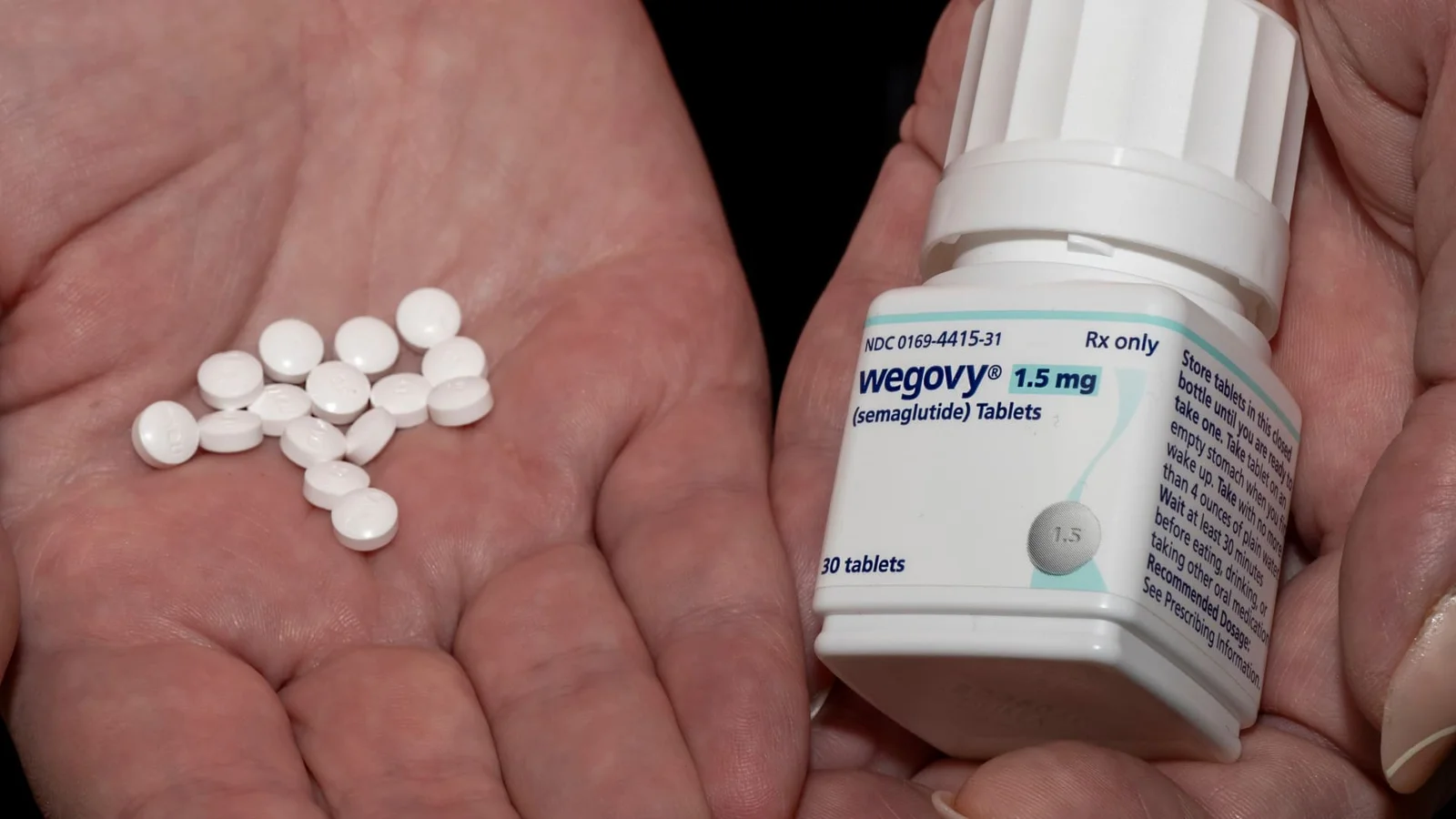

Novo Nordisk plans to invest up to $2.1 billion in Vivtex to advance next-generation oral delivery systems for biologics, leveraging Vivtex’s GI tract screening platform developed in MIT labs. Novo will fund research and later development and commercialization, aiming to expand its lead in oral obesity and diabetes therapies after Wegovy’s pill launch, while Vivtex pursues broad partnership opportunities and potential standalone programs.