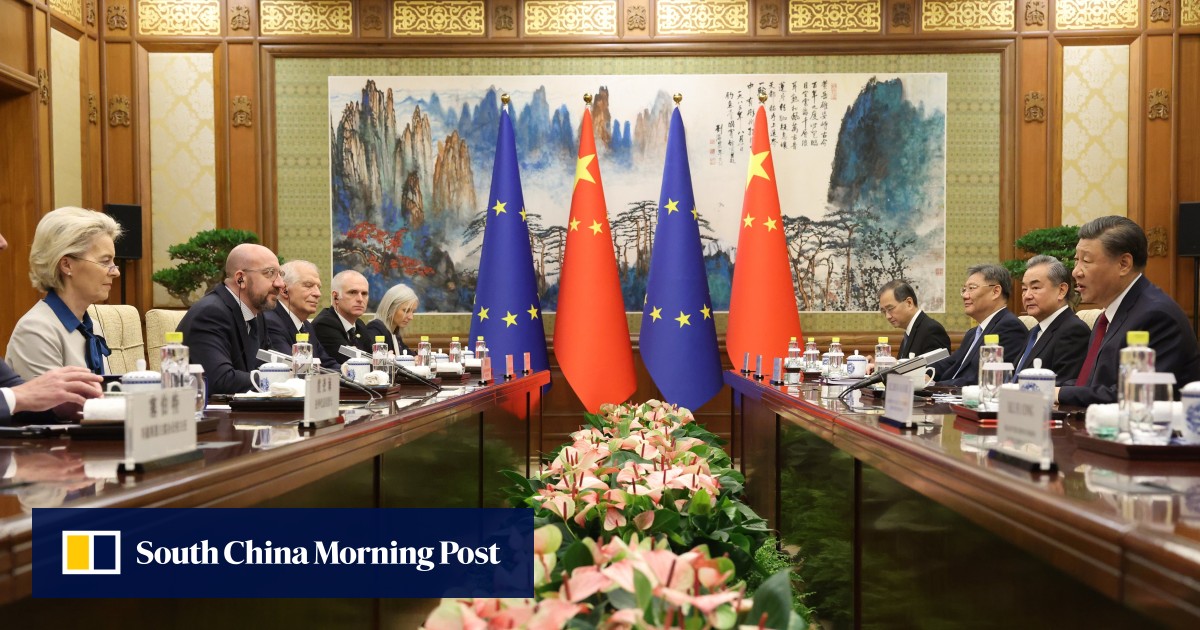

Germany pushes for a fair trade reset with China to curb ballooning deficit

German Chancellor Friedrich Merz urged a fair rebalance of Germany’s trade with China to shrink a €90 billion 2025 deficit driven by Chinese overcapacity, calling for transparency, level competition and rule-based trade; he traveled with a business delegation, noted potential Airbus orders, and pressed China to influence Moscow to end Russia’s aggression in Ukraine.