Businesseconomics News

The latest businesseconomics stories, summarized by AI

Featured Businesseconomics Stories

Global Metal Prices Soar as US and UK Impose Sanctions on Russian Supply

Aluminium and nickel prices surged following the imposition of sanctions on Russian supply, as concerns over disruptions to the global supply chain intensified. The sanctions, imposed in response to Russia's invasion of Ukraine, have raised fears of potential shortages and supply chain disruptions, leading to a sharp increase in commodity prices.

More Businesseconomics Stories

"Jamie Dimon's Stark Economic Warnings for America and the World"

JPMorgan Chase CEO Jamie Dimon emphasized the need for the U.S. to engage with China, acknowledging China's rise as a potential superpower and the U.S.'s underestimation of its economic strength. Dimon highlighted concerns about the U.S.'s dependency on China for supply chains and national security, urging the U.S. to maintain its position in key industries and execute a comprehensive economic security strategy. He advocated for respectful engagement with China to address the current situation and secure the U.S.'s position in the global economy.

"China's Robust Factory Activity Signals Strong Economic Recovery"

China's manufacturing activity expanded at the fastest pace in 13 months in March, with the Caixin/S&P Global manufacturing PMI rising to 51.1, driven by growing new orders from domestic and international customers. The upbeat results, along with better-than-expected export and retail sales data, suggest a strong start to the year for the world's second-biggest economy. Citi raised its 2024 growth forecast for China to 5.0%, but analysts believe policymakers will need to roll out more stimulus to achieve this target due to ongoing challenges such as a deep slump in the property sector and subdued employment growth.

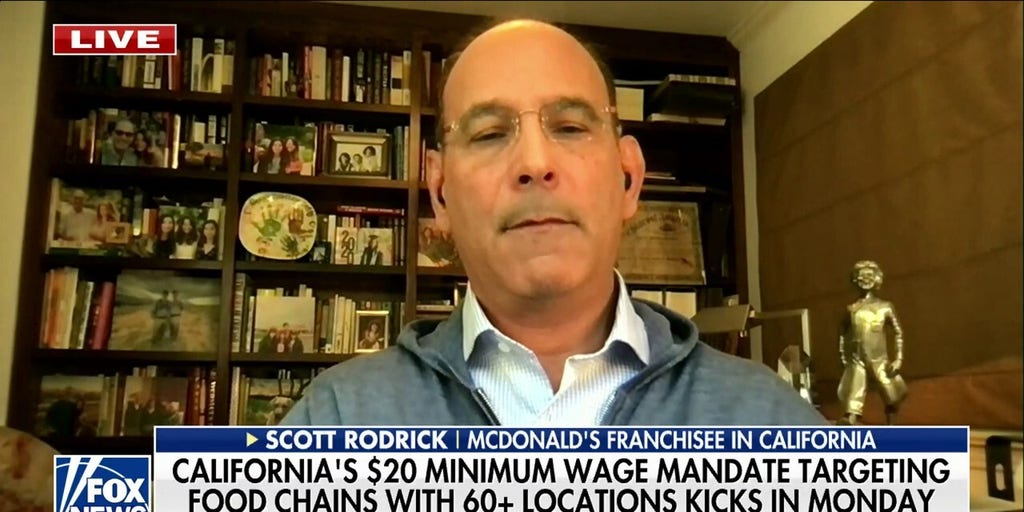

"California Fast Food Workers Eligible for $20/Hour Minimum Wage"

Scott Rodrick, a business owner, criticizes California's minimum wage mandate as "unprecedented, let alone extraordinary," in a Fox News video, highlighting concerns about its potential impact on businesses and the economy.

"Cocoa Crisis: Rising Prices and Shrinking Sweets Threaten Chocolate Industry"

Ghana and Ivory Coast, the world's top cocoa producers, are facing catastrophic harvests due to a combination of factors including illegal mining, climate change, mismanagement, and disease. This has led to expectations of cocoa bean shortages, causing New York cocoa futures to more than double in price. The crisis could mark the end of West Africa's cocoa supremacy and lead to higher chocolate prices for consumers in the near future.

"Rising Trend: Americans Seek Second Passports and Residency in Wealthy Sun Belt Cities and Abroad"

According to a recent report by Henley & Partners, Austin, Texas, has seen the highest growth rate of millionaire residents in the US over the past decade, followed by Scottsdale, Arizona, and Palm Beach/West Palm Beach, Florida. While traditional hubs like New York and Los Angeles have experienced modest declines in millionaire populations, cities such as Austin, Miami, and Scottsdale are gaining residents, indicating a shift in wealth distribution within the country.

"February 2024 Sees Rebound in US Housing Starts for New Home Construction"

US housing starts for new home construction rebounded sharply in February, increasing by 10.7% to a 1.52 million annualized rate, the largest rise since May. This recovery comes after a period of weather-related weakness at the beginning of the year, with builders benefiting from slightly more favorable mortgage rates and a shortage of existing houses for sale.

"Real-Estate Billionaire Barry Sternlicht's Solution to U.S. Inflation: Congress Must Curb Spending"

Real-estate billionaire Barry Sternlicht suggests that the U.S. inflation problem could be addressed by urging Congress to curb excessive spending, criticizing the Federal Reserve's reliance on interest rate hikes as ineffective. Despite previously condemning the Fed's actions, Sternlicht now believes that the rate hikes have not slowed the economy and are instead harming key sectors, including real estate. He describes the current real estate situation as a once-in-a-lifetime crisis and emphasizes the need for a different approach to combat inflation.

"Study Links Rising Prices of Toilet Paper and Snacks to 'Shrinkflation'"

A study by progressive economists has found that "shrinkflation," where companies charge the same or more for smaller portions of products, has been a significant driver of inflation in various categories such as household paper products and snacks between 2019 and 2023. This practice has contributed as much as 10% to inflation in key product categories, prompting calls from lawmakers and President Biden to address it. The study also highlighted examples of companies using shrinkflation to boost profits, with one CEO noting that consumers are unlikely to change their buying habits even if they realize they're paying more for less.

"Consumers Push Back Against Inflation: Retailers and Brands Take Notice"

Consumers in the US are pushing back against price increases by shifting to store-brand items, discount stores, and buying fewer items, leading to a slowdown in inflation. Large food companies have responded by slowing their price increases, and public frustration with high prices has become a central issue in President Biden's re-election bid. Consumer resistance suggests that inflation should further ease, and companies are now reining in price increases and focusing on boosting sales. Officials at the Federal Reserve cite consumers' growing reluctance to pay high prices as a key reason why they expect inflation to fall steadily back to their 2% annual target.

"BHP Warns Australian Support for Nickel Miners May Fall Short"

BHP, the world's largest mining company, has expressed doubts about the Australian government's support being enough to save the country's struggling nickel industry. Despite the government's efforts to aid the industry, BHP believes that additional measures may be necessary to ensure the sustainability of nickel mining in Australia.