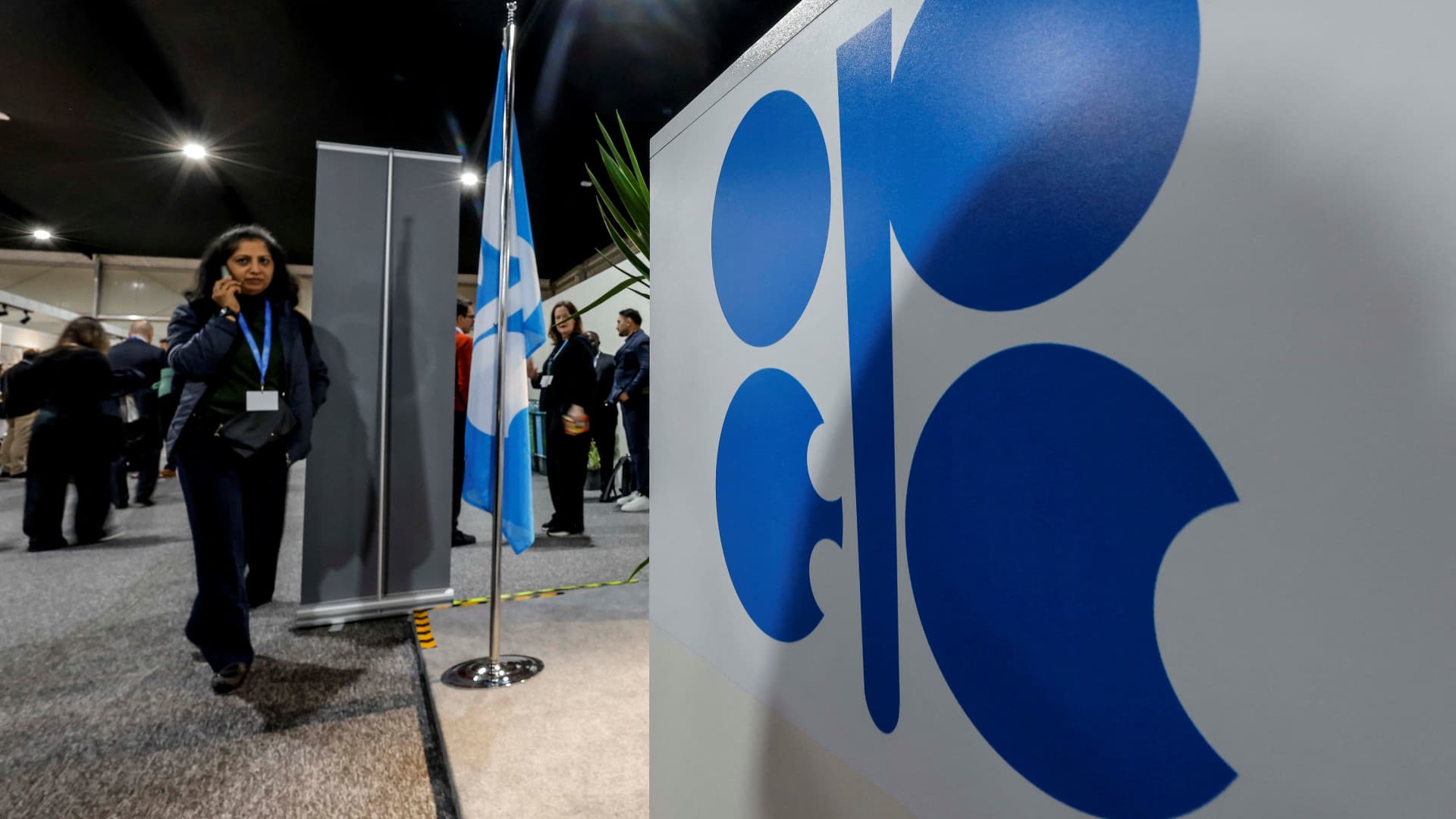

OPEC+ Maintains Steady Oil Output Despite Member Tensions

OPEC+ members decided to keep oil output steady amid geopolitical tensions and a significant drop in oil prices, prioritizing market stability over increasing supply despite internal and external crises affecting member countries.