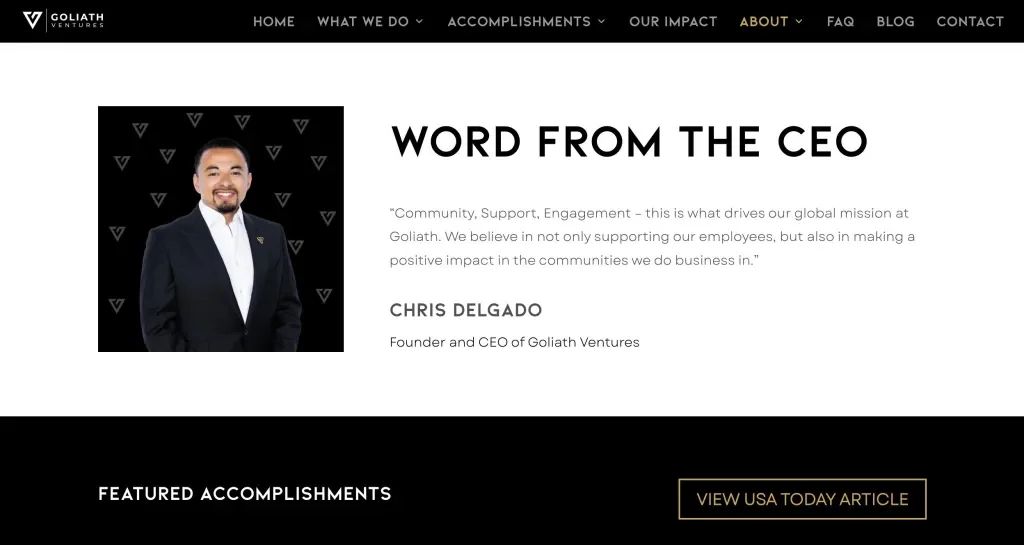

Orlando crypto CEO’s $328M Ponzi scheme alleged to fund lavish life and real estate

The DOJ accuses Christopher Delgado, 34, founder/CEO of Orlando-based Goliath Ventures, of running a $328 million Ponzi scheme from 2023 to 2026 that misused investor funds—only about $1 million went into a crypto liquidity pool while the rest paid earlier investors, financing lavish events and four luxury homes in Windemere, Winter Park, Kissimmee, and Sanford; Delgado was arrested on wire fraud and money-laundering charges and had public ties to charities and local politics.