Goolsbee urges Fed to hold steady on rates until inflation convincingly cools

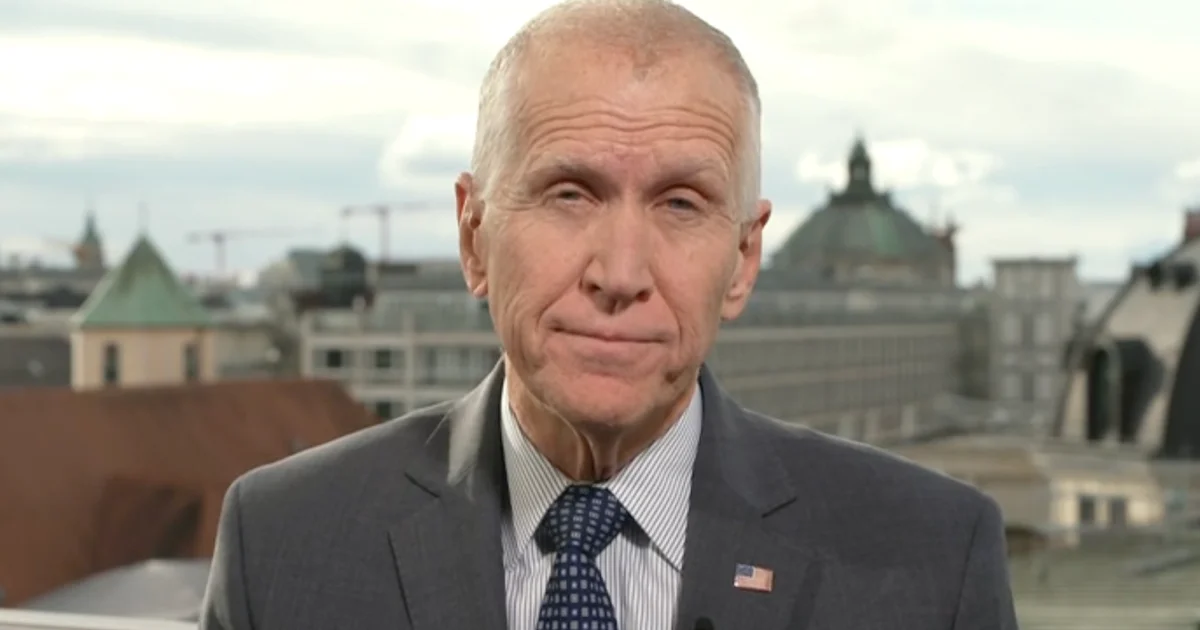

Chicago Fed President Austan Goolsbee said rate cuts aren’t appropriate until there’s clearer evidence that inflation is heading down toward the 2% target, highlighting December core inflation at 3% and persistent housing costs. He warned against front-loading cuts and stressed the need to prove inflation is on a path back to 2% before loosening policy, while markets price in a hold through mid-2025 with potential cuts later in the year.