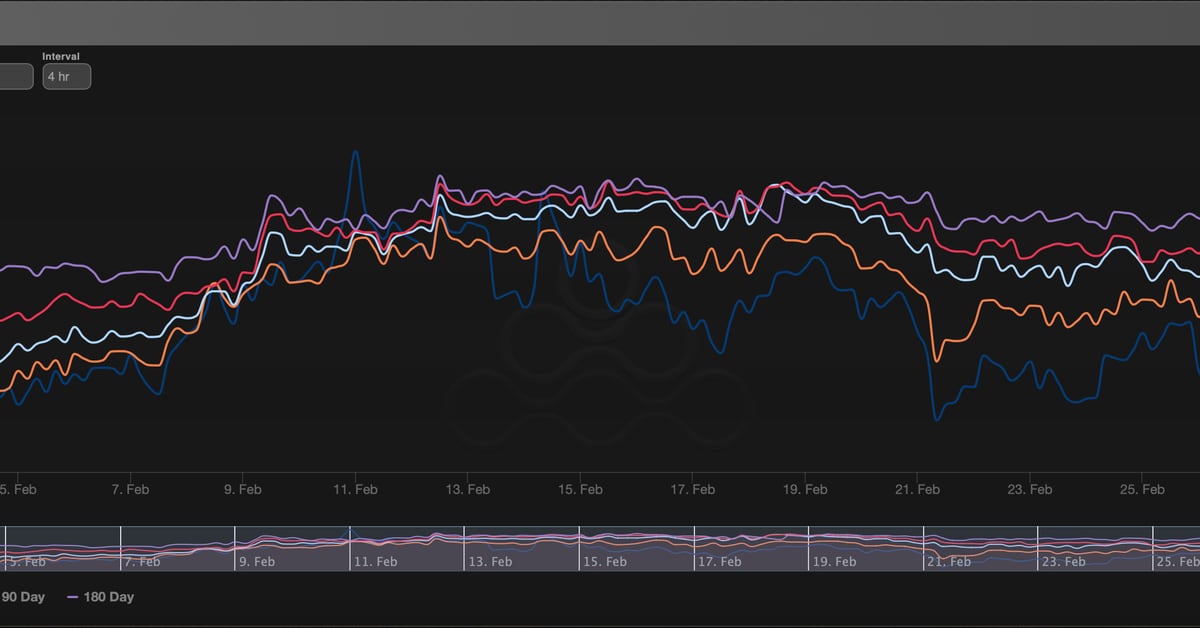

Bitcoin steadies after weekend rout as traders eye critical $73k support

Bitcoin dipped below $75,000 over the weekend and then rose to around $78,000, but traders monitor a key support near $73,000; a break there could push prices toward $60,000 by end-February as liquidity and Fed policy expectations weigh on the market. January was the fourth straight monthly drop, with over $5 billion in crypto liquidations in four days and substantial ETF outflows signaling renewed risk-off sentiment. Analysts are divided: some fear deeper downsides while others see potential for a rebound if liquidity returns and ETF flows stabilize.