AI-fueled Investment Boom Pushes Core Capital Goods to Fresh Highs

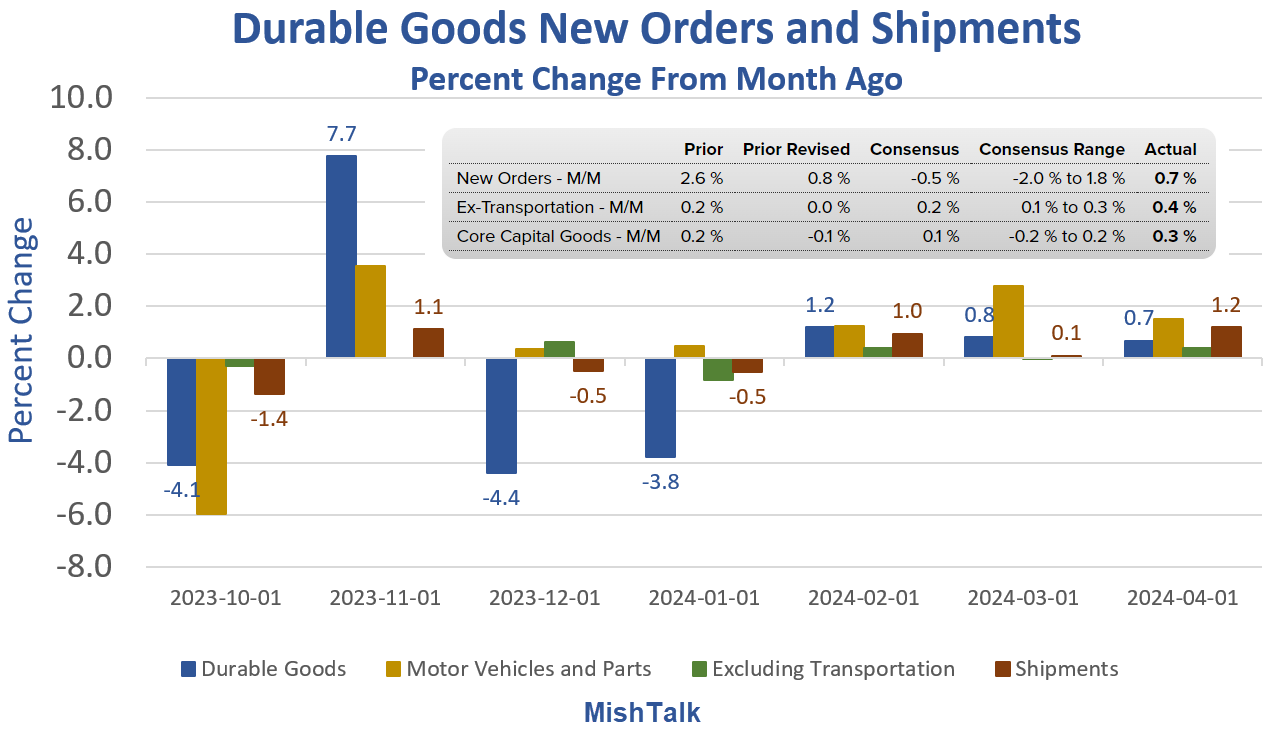

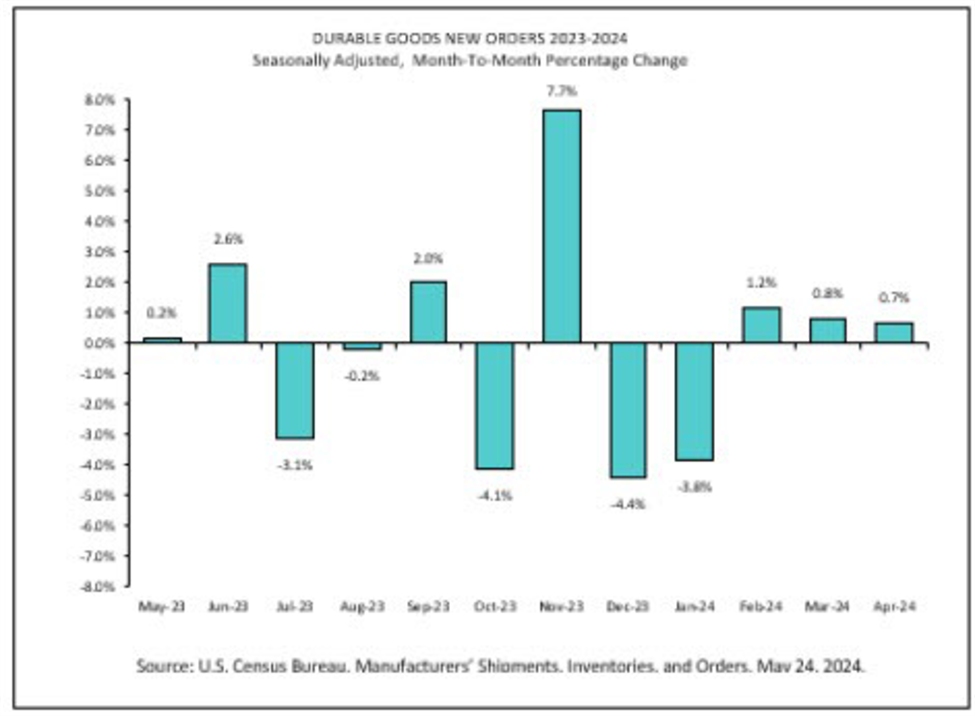

US November core capital goods orders rose 0.7% from October to a record $78.4 billion, part of a five‑month surge that signals robust business investment aided by AI infrastructure buildout across fabricated metal products, machinery, and electronics. While this suggests continued growth, the underlying story remains that the boom could fade if projects don’t translate into sustained demand or profits.