Meta and AMD Forge Long-Term AI Compute Partnership

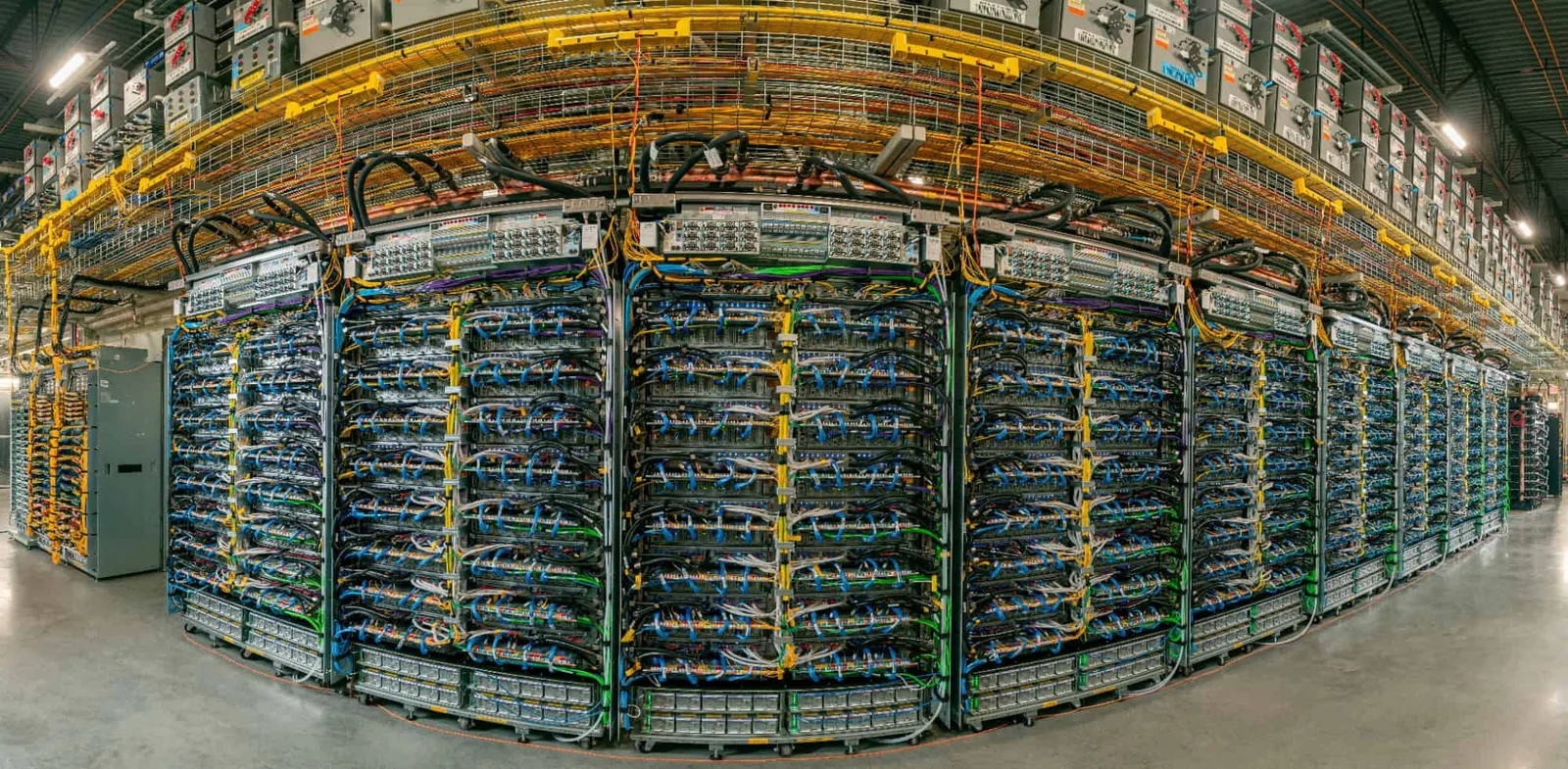

Meta and AMD announced a multi-year agreement to power Meta's AI infrastructure with up to 6GW of AMD Instinct GPUs, aligning roadmaps across silicon, systems and software as part of Meta Compute; shipments for the first deployments begin in H2 2026 on the Helios rack-scale architecture, marking a diversification of Meta's AI compute stack and accelerating its personal AI ambitions.