December inflation ticks up again, keeping Fed wary of slow cooling

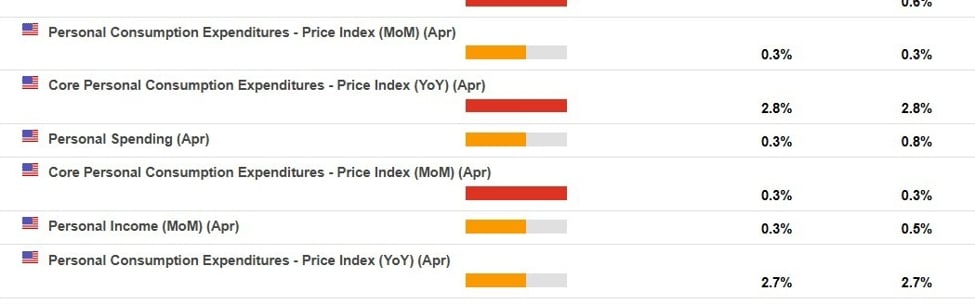

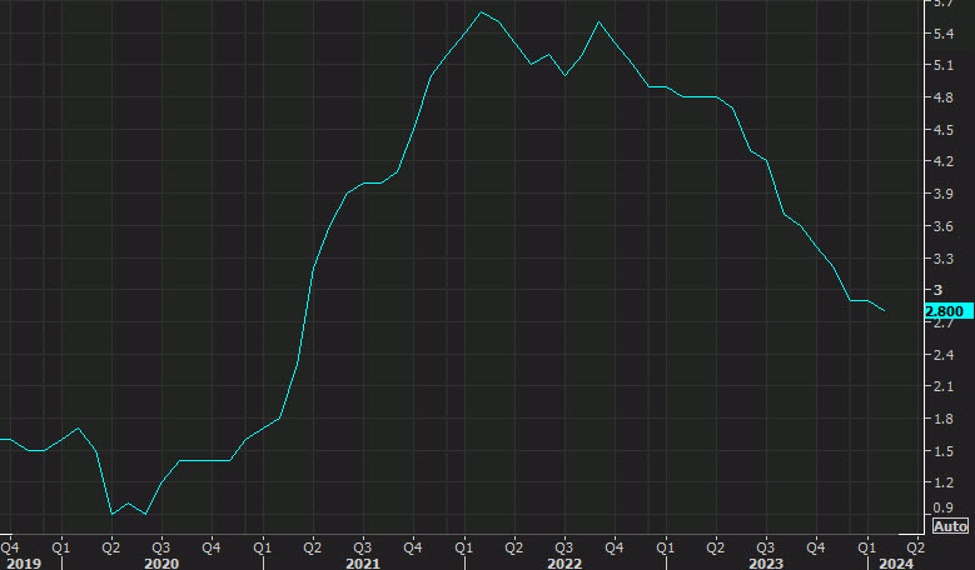

U.S. inflation accelerated in December as the Commerce Department’s PCE price index rose 0.4% for the month and 2.9% from a year earlier, the fastest yearly rise since March 2024. Core PCE also climbed 0.4% MoM and 3.0% YoY. Yet spending rose 0.4% and while gas prices fell, electricity and natural gas costs rose. The Federal Reserve left rates around 3.6%, with officials wanting inflation closer to 2% before considering rate cuts.