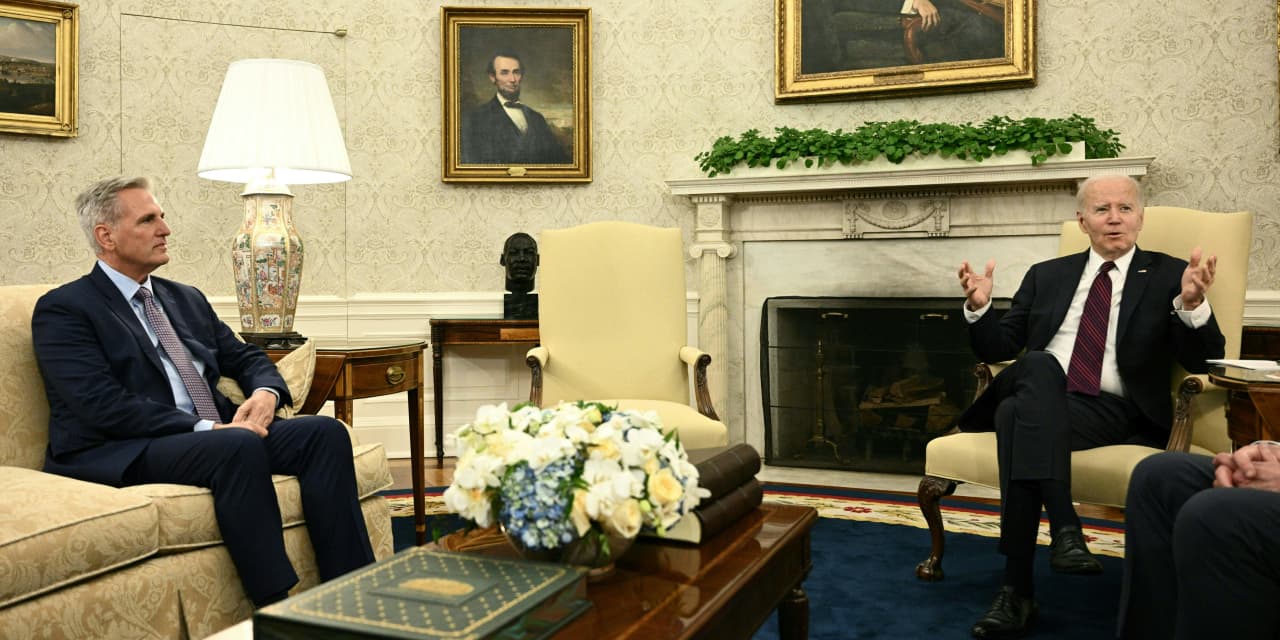

US Debt Ceiling Crisis Averted with Tentative Deal

President Joe Biden and House Speaker Kevin McCarthy have reached an agreement in principle on legislation to increase the nation’s borrowing authority and avoid a federal default. The agreement would keep nondefense spending roughly flat in the 2024 fiscal year and increase it by 1% the following year, as well as provide for a two-year debt-limit increase. The deal would fully fund medical care for veterans at the levels included in Biden’s proposed 2024 budget blueprint, including for a fund dedicated to veterans who have been exposed to toxic substances or environmental hazards. The agreement would expand some work requirements for the Supplemental Nutrition Assistance Program, or SNAP, formerly known as food stamps. The deal puts in place changes in the National Environmental Policy Act that would designate “a single lead agency” to develop environmental reviews, in hopes of streamlining the process.