Yellen Warns US Debt Risks and Fiscal Dominance Threats

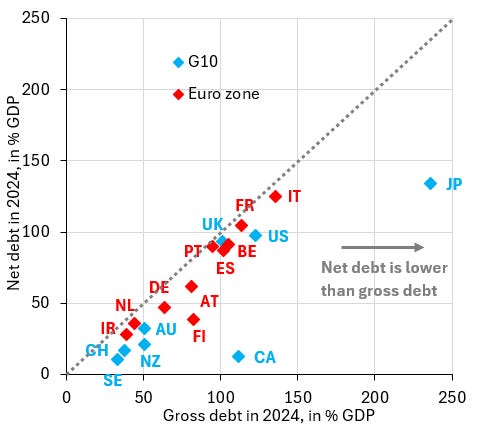

Janet Yellen warns that the US approaching a dangerous level of national debt could lead to fiscal dominance, where debt constraints limit the Federal Reserve's ability to control inflation, risking hyperinflation and economic instability, especially as debt surpasses 120% of GDP.