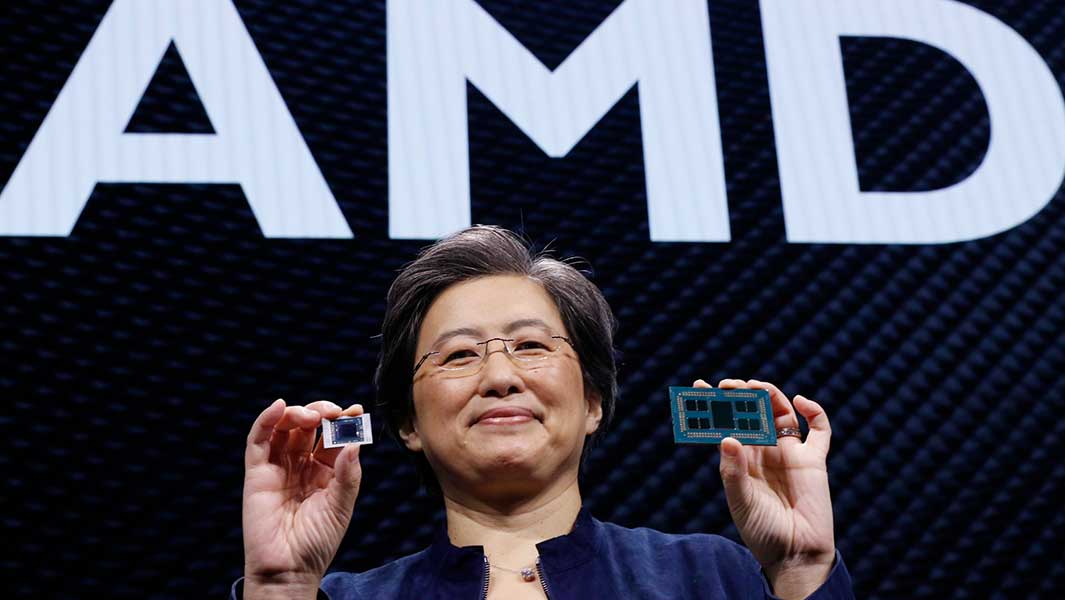

Nvidia's Stock Skyrockets After Impressive Quarter and Guidance.

Dow Jones futures fell slightly overnight, along with S&P 500 futures and Nasdaq futures. The Nasdaq and especially the Nasdaq 100 surged as Nvidia skyrocketed on strong earnings and blowout guidance. Debt-ceiling talks continued throughout Thursday. The Commerce Department will release the personal consumption expenditures price index, the Fed's favorite inflation gauge, at 8:30 a.m. ET Friday. The stock market rally showed extreme divergence on Thursday, with the Nasdaq 100 spiking more than 2% while losing stocks outpaced winners by two-to-one.