Blue Owl sells $1.4B loan portfolio to pensions and its insurer

Blue Owl Capital reportedly sold a $1.4 billion portfolio of loans at about par (99.7%) to major pension funds and its own insurer to raise cash for private-credit redemptions.

All articles tagged with #insurers

Blue Owl Capital reportedly sold a $1.4 billion portfolio of loans at about par (99.7%) to major pension funds and its own insurer to raise cash for private-credit redemptions.

The Trump administration proposed Medicare insurer payment rates that were lower than analysts expected, triggering a sharp selloff in stocks of UnitedHealth Group, Humana, and CVS Health as investors priced in tighter reimbursements.

Five major health insurers’ CEOs (UnitedHealth Group, CVS Health, Cigna Health, Elevance Health, and Ascension) are set to testify before House Energy and Commerce and Ways and Means committees as Republicans blame rising premiums on the system and the expiration of enhanced ACA subsidies; with no quick fix in sight and Congress stalled on extending subsidies, the hearings will probe root causes of higher costs, including the ACA’s impact, while insurers argue premiums reflect overall care costs and provider prices rather than their pricing alone, and Trump’s plan is not the focus of this round.

The 2026 Medicare Advantage star ratings remained stable overall, with some insurers like Elevance and Centene improving, while others like Humana and Aetna saw declines. Clover Health experienced a significant drop below 4 stars, potentially impacting its earnings. The ratings influence insurer revenues and strategies, with some plans adjusting their offerings to maintain or improve their scores amid regulatory and market pressures.

The U.S. government released 2026 Medicare plan quality ratings, showing most plans, especially those from CVS Health, UnitedHealth, and Elevance, are rated highly, impacting insurer payments and highlighting ongoing improvements in healthcare quality for beneficiaries.

Major insurers are uncertain about whether they will continue to cover childhood vaccines if the CDC's Advisory Committee on Immunization Practices (ACIP) stops recommending certain vaccines, following a recent review of the vaccination schedule and changes in committee membership led by Robert F. Kennedy Jr. Only Blue Shield of California confirmed it would maintain coverage, while others are monitoring the situation. The review and political shifts have raised concerns about the future of vaccine coverage and public health policy.

Major health insurers have pledged to reform the controversial practice of prior authorization, aiming to speed up decision-making, reduce delays, and improve transparency for patients and doctors, amid mounting criticism and regulatory pressure.

Health Secretary Robert F. Kennedy Jr. has withdrawn CDC recommendations for COVID-19 vaccines for healthy kids and pregnant women, potentially reducing insurance coverage and access for these groups, despite ongoing risks and the importance of vaccination for vulnerable populations.

A recent study led by researchers at Harvard University, Columbia University, and the Federal Reserve Board warns that smaller, lower-quality insurers are replacing major private home insurers that have left Florida, leading to a crisis in the state's home insurance sector. These new insurers are found to be less financially stable and may not meet the minimum requirements set by government guidelines. The exodus of bigger private companies from high-risk areas in Florida has led to a reliance on approximately 50 small insurers, all rated by a single company, Demotech Inc., whose ratings differ significantly from those of other rating agencies. The situation has been exacerbated by factors such as excessive litigation, widespread fraud, and the increased risk of severe weather events due to climate change.

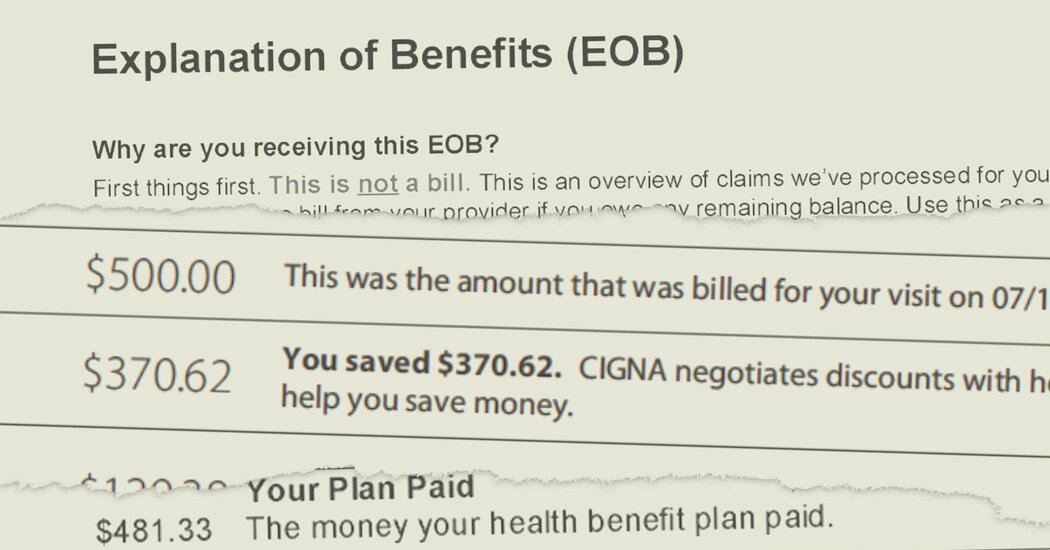

A little-known data firm called MultiPlan helps health insurers maximize profits by negotiating lower payments for out-of-network claims, leaving patients responsible for the remaining balance. This practice has resulted in patients receiving unexpected bills amounting to tens of thousands of dollars, despite having insurance coverage. MultiPlan and insurers typically receive a percentage of the "savings" on each claim, creating a financial incentive to recommend lower payments. Confidential pricing and fee data, as well as insurance statements, have shed light on the extent of these hidden fees and the impact on patients.

California's Insurance Commissioner, Ricardo Lara, is facing the challenge of luring insurers back to the state after major companies like Allstate, Star Farm, and Farmers Insurance limited or stopped coverage due to the growing risk of wildfires. Lara's plan involves requiring insurers to write policies in fire-prone areas in exchange for faster decisions on rate requests. However, insurers may demand rate increases of up to 40% to accommodate the higher risk. The situation reflects a business model unprepared for environmental disasters, leaving homeowners in a difficult position.

Some patients with type 2 diabetes in the US are facing difficulties in getting reimbursed for drugs like Ozempic as insurers tighten coverage restrictions to discourage doctors from prescribing the medication for weight loss. This trend has led to a decline in US prescriptions, causing delays and disruptions for diabetes patients. Insurers are implementing prior authorization requirements, forcing patients to try other drugs before being allowed to access newer medications. The high cost of these medications and the paperwork burden on physicians are additional challenges. Patients and doctors are preparing for potential changes in coverage terms in January.

Some patients with type 2 diabetes in the US are facing difficulties in getting reimbursed for drugs like Ozempic as insurers tighten coverage restrictions to discourage doctors from prescribing the medication for weight loss. This trend has led to a recent decline in US prescriptions, causing delays and disruptions for diabetes patients. Insurers are implementing prior authorization requirements, forcing patients to try other drugs before being allowed to access newer medications. The average number of weekly Ozempic prescriptions has dropped by over 6% since the third quarter of this year. Patients and doctors are preparing for changes in coverage terms in January, which may further impact access to these medications.

Ukraine has reached a deal with insurers for grain shipments, ensuring coverage for its agricultural exports.

Open enrollment for Affordable Care Act (ACA) insurance plans is underway, with a sign-up period that extends until January 15. Last year's enrollment reached a record high of 15.7 million, and this year's enrollment is expected to exceed that. Factors driving up enrollment include the ongoing disenrollment of beneficiaries from Medicaid, new sign-up mechanisms, and increased engagement from insurers. This year, applicants will have more time to submit income verification documents, and those already enrolled will be automatically reenrolled with some changes to ensure they are eligible for cost-sharing reduction plans. More insurance providers are entering the market, offering a wider range of options, but the abundance of choices may be overwhelming for some. The ACA's Navigator program is available to assist consumers in navigating the enrollment process.