Health Insurance News

The latest health insurance stories, summarized by AI

Featured Health Insurance Stories

The Mystery Behind Health Insurance Claim Denials

UnitedHealthcare is under scrutiny for its high claim denial rates, with reports suggesting it has the highest rate in the industry at 32%. The company's CEO was recently shot, with shell casings found at the scene bearing words associated with insurance denial tactics. Despite regulations allowing for transparency, the federal government has not collected or shared much data on claim denials. Reports indicate that denials, particularly for Medicare Advantage plans, have been increasing, with AI tools being used to deny claims.

More Top Stories

"Uncovering Hidden Fees: How Insurance Companies Profit at Patients' Expense"

The New York Times•1 year ago

More Health Insurance Stories

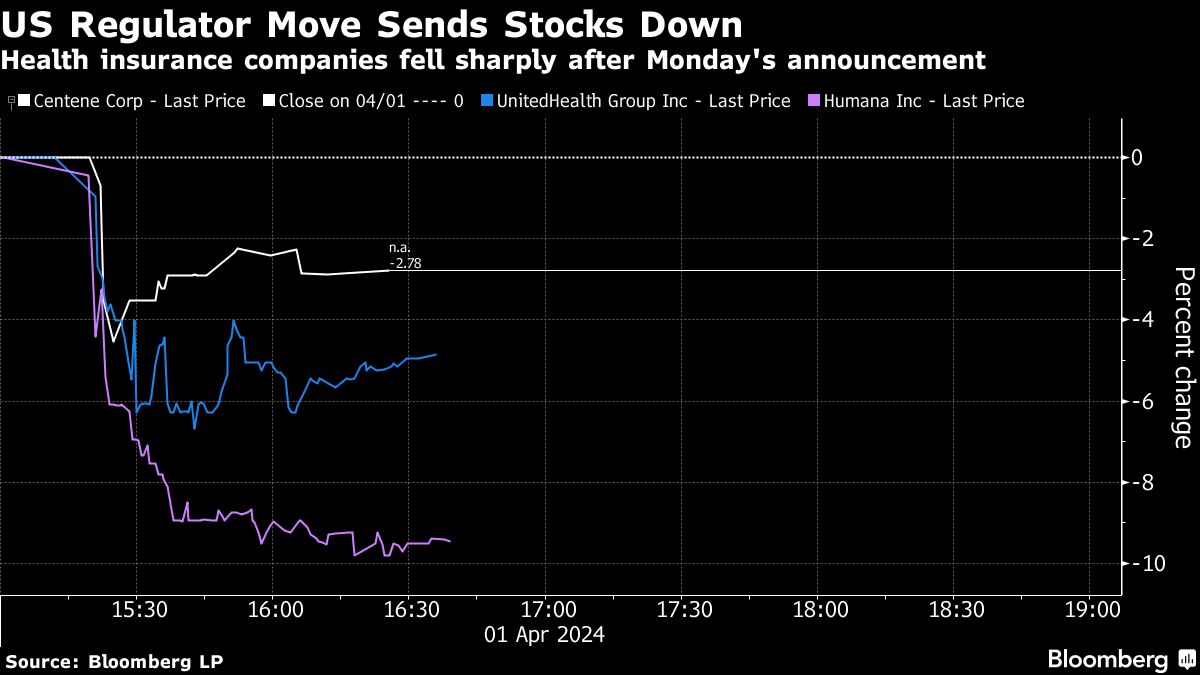

"Health Insurers Face Tumble as 2025 Medicare Advantage Rates Disappoint"

Health insurance stocks tumbled as US regulators decided not to increase payments for private Medicare plans, breaking from recent practice and surprising Wall Street. The decision signals another hurdle for insurers already facing faster-than-expected increases in medical costs. The announcement, which will result in a 0.16% decline in payments after excluding an estimate of how plans code for patient illnesses, is expected to put more pressure on health insurance plans. This move by the Biden administration reflects a tightening of payment policies and efforts to claw back past overpayments, impacting the industry's growth and profits.

"Unauthorized Changes: ACA Health Insurance Plans Switched Without Consent"

Insurance brokers are reportedly switching consumers covered by Affordable Care Act (ACA) insurance plans to new plans without their knowledge, potentially leaving them unable to access their doctors or prescriptions. This unauthorized enrollment or plan-switching is a growing issue, with rogue agents accessing policyholder accounts through the federal marketplace and collecting commissions on the new plans. Some consumers face IRS bills for back taxes due to misstated income, while others find themselves in plans they didn't choose, leading to difficulties in accessing healthcare services. Federal regulators are aware of the problem and have taken steps to combat it, but the issue persists, particularly in states served by the federal marketplace.

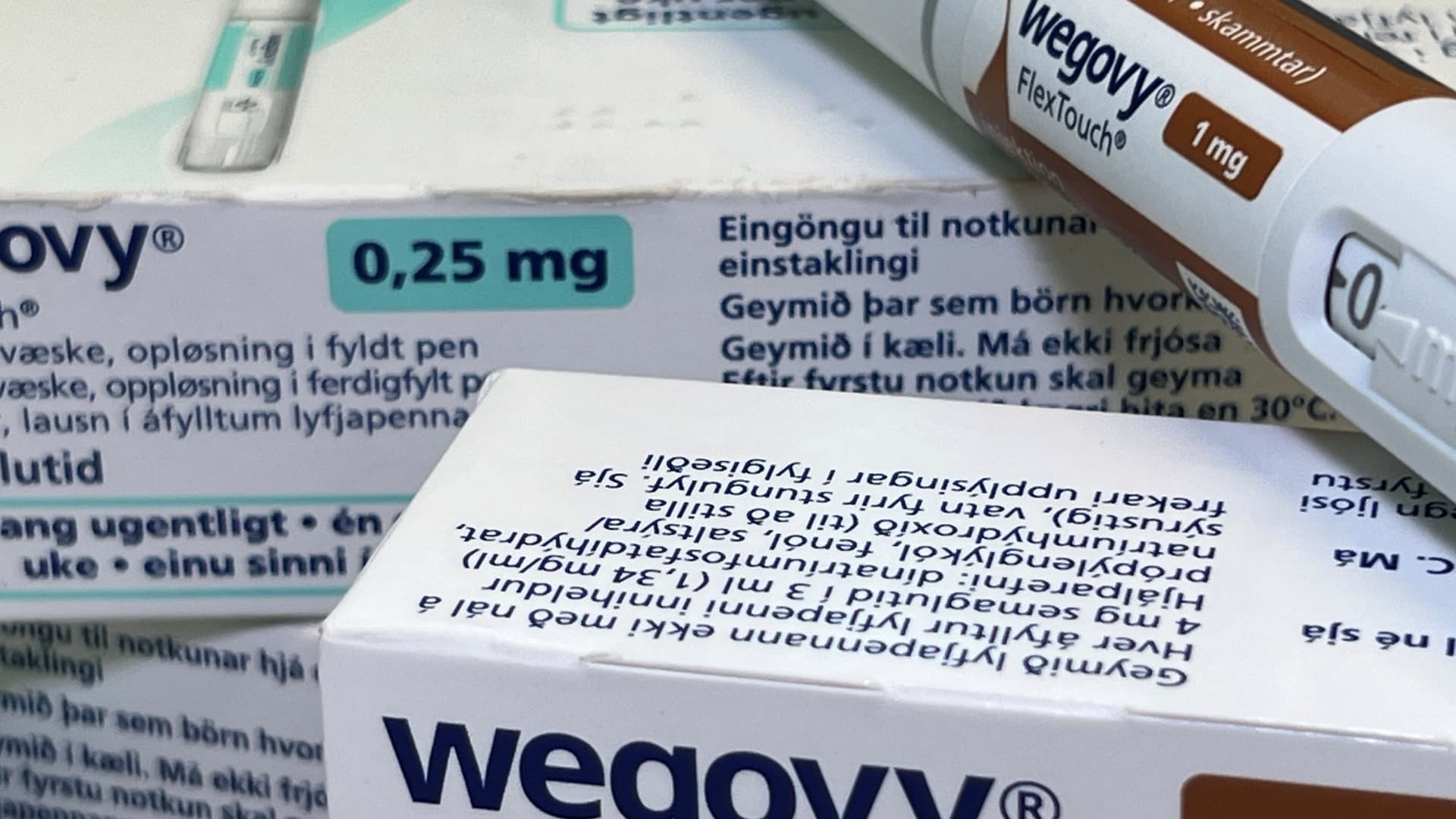

"Expanding Access to Heart-Healthy Weight Loss Drugs: The Wegovy and Semaglutide Revolution"

The weight loss drug Wegovy, previously approved for weight management, has now been approved for heart health as well. However, its $1,350 monthly cost has led to reluctance from some employers and health plans to provide coverage. While some insurers may consider covering the treatment in the future, questions remain about its long-term use and cost effectiveness. The drug's approval highlights its potential downstream health benefits for severe conditions caused by obesity, but concerns about its cost and long-term use persist among insurers and employers.

"Aetna Insurance Coverage at Risk in New York-Presbyterian Health System"

Aetna and New York-Presbyterian are in contract negotiations, and if an agreement isn't reached by the end of March, tens of thousands of Aetna-insured New Yorkers could lose coverage for New York-Presbyterian's hospitals and physician networks. The dispute revolves around reimbursement rates, with both sides blaming each other for the impasse. This situation reflects a broader trend of large health insurers and major hospital networks clashing over payment rates, potentially disrupting patients' care and limiting their options.

"Changing Landscape: The Future of Obesity Medicine and Access to New Weight Loss Drugs"

Many U.S. companies are facing challenges in providing health insurance coverage for GLP-1 drugs used for weight loss, despite increasing demand. The high cost, lack of long-term data on effectiveness, and potential side effects are causing employers to grapple with coverage decisions. While some are already providing coverage with limitations, others are considering it. Employers are concerned about the substantial costs, with some already covering the drugs citing higher employee satisfaction and wellbeing. Consumers without coverage may face significant out-of-pocket expenses, but some may be eligible for manufacturer assistance programs. Despite the current coverage challenges, experts expect that most companies will eventually provide coverage for these drugs due to their potential long-term benefits.

"Blue Cross Blue Shield Louisiana Halts Transaction Plans and Hearing in Last-Minute Decision"

Blue Cross and Blue Shield of Louisiana has decided to pause its acquisition plans and withdraw its plan of reorganization with Elevance Health, prompting the cancellation of a Louisiana Department of Insurance hearing. The Louisiana Attorney General, Liz Murrill, has issued a statement on the matter, and more information about the withdrawn transaction can be found on the WAFB website.

Blue Cross Blue Shield of Mass. Delays Controversial Colonoscopy Anesthesia Policy

Blue Cross Blue Shield of Massachusetts has decided to delay a controversial change in insurance coverage for endoscopic procedures, including colonoscopies, following opposition from leading healthcare organizations. The change would have limited coverage for full sedation during procedures, with doctors needing to determine its medical necessity. Some healthcare providers argued that this change would restrict access to colonoscopies and potentially compromise patient safety, while others suggested it was a cost-cutting measure. Blue Cross cited confusion about the policy as the reason for the delay and stated that they are working to ensure members understand all their options for colon cancer screening and sedation.

"Rising Weight Loss Medication Costs Pose Threat to Patient Access and Budgets"

Many patients who have found success with powerful new weight loss medications like Wegovy and Zepbound are facing insurance denials, leaving them with difficult choices. Most employer insurance plans and Medicare do not cover these medications, and some employers are now narrowing the criteria for coverage, creating hurdles for patients. Economists argue that while the medications are expensive, they could lead to substantial cost savings by preventing other serious medical conditions. However, insurers are hesitant due to uncertainties about the long-term effects and a misalignment of incentives. Patients and healthcare providers are struggling with time-intensive prior authorizations and changing coverage requirements, leading to tough discussions and tough choices for patients like Macarena Khoury, who has resorted to using a compounded version of her old weight loss drug after insurance denials.

"Mark Your Calendars: 2024 Health Benefits Open Season Starts November 13!"

The 2024 Health Benefits Open Season for federal employees will take place from November 13 to December 11. Two smart medical plans, the High Option and Consumer Driven Option, are available, both offering nationwide coverage with no referrals needed. The High Option features low copays and deductibles, while the Consumer Driven Option includes a Personal Care Account to help pay for medical expenses. Premium rates vary depending on enrollment type. Additionally, various health and wellness programs, such as gym discounts and virtual support for pregnancy, are offered.

Obese Woman Sues Health Insurer for $700,000 Over Weight Coverage Denial

Luci 'Lynette' Solorio is suing her health insurance company, Regence Blueshield, for $700,000 after they refused to cover her obesity treatment, including a follow-up bariatric surgery. Solorio claims that the surgery was medically necessary and that Regence's actions were illegal and unreasonable under Washington state law. She now owes over $700,000 to multiple medical providers and the hospital where she had the surgery. This lawsuit is one of two recent cases challenging insurers for not covering obesity treatments, arguing that the rejection of coverage is a form of discrimination.