Risks of Privatizing Fannie Mae and Freddie Mac

Privatizing Fannie Mae and Freddie Mac improperly could lead to a second Great Recession by destabilizing the housing market and financial system.

All articles tagged with #financial stability

Privatizing Fannie Mae and Freddie Mac improperly could lead to a second Great Recession by destabilizing the housing market and financial system.

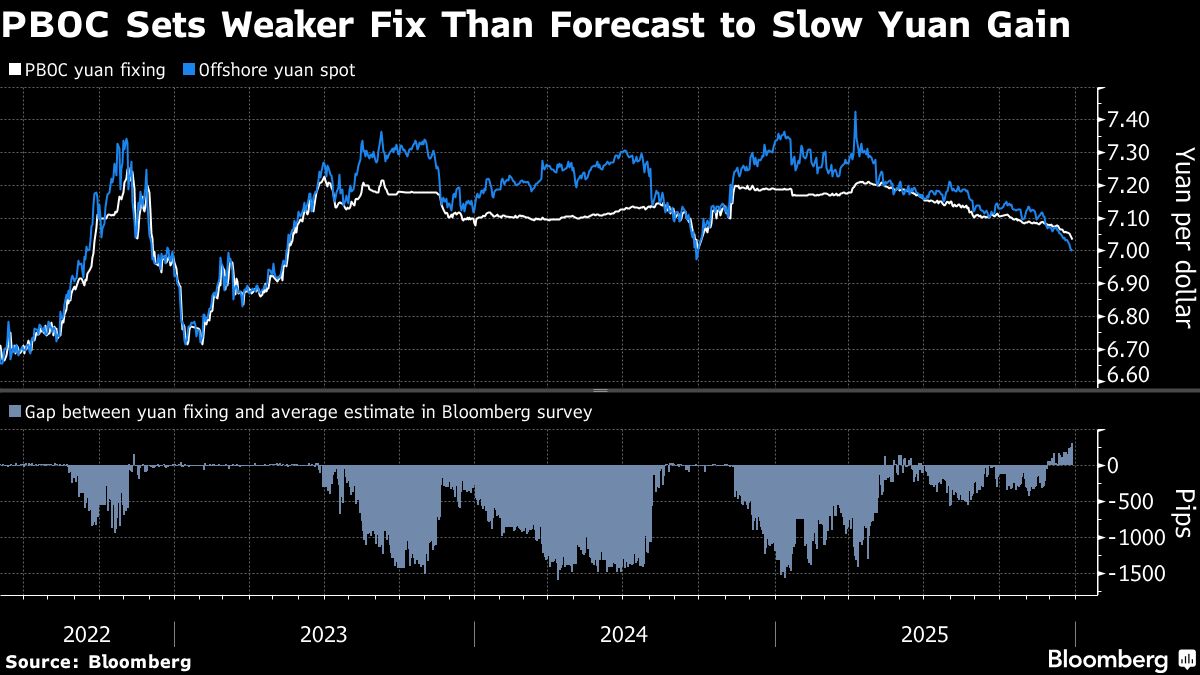

China's central bank, PBOC, has committed to preventing the yuan from overshooting its target exchange rate, signaling a cautious approach to currency appreciation amid predictions of further strengthening in 2026, while maintaining exchange rate flexibility and stability to manage economic rebalancing and trade tensions.

In 2026, signs of having retired well in America include paying off your mortgage, managing healthcare costs effectively, and maintaining good health, which can significantly reduce financial stress during retirement.

The article discusses how a Swiss compromise could potentially save UBS billions, highlighting the importance of strategic negotiations and regulatory considerations in maintaining financial stability.

Investors are seeking safeguards against potential risks associated with a possible AI debt crisis, highlighting concerns over financial stability in the evolving AI industry.

Bond investors have issued a warning to the US Treasury regarding the potential appointment of Kevin Hassett as the Federal Reserve Chair, citing concerns over financial stability and market impact.

The horoscope for November 12, 2025, suggests stable returns for certain zodiac signs, with positive developments in family, health, and finances, and opportunities for love and career growth, depending on individual astrological influences.

The article highlights three top Dividend Kings—Procter & Gamble, Johnson & Johnson, and Emerson Electric—that offer reliable, long-term dividend growth, stable financials, and strong analyst ratings, making them ideal for income-focused investors seeking stability and potential for wealth accumulation.

U.S. regional banks are under scrutiny as recent loan losses and fraud issues raise concerns about sector-wide credit risks, with investors reacting to signs of potential deterioration in asset quality and broader financial stability.

Jamie Dimon warns that recent failures of auto lenders Tricolor and First Brands may indicate more problems in the US credit market, raising fears of further lending blow-ups on Wall Street.

The collapse of two US private credit firms highlights the sector's rapid growth, risks, and regulatory challenges, raising concerns about financial stability and transparency in an industry that has become a significant part of the global economy.

The UK stock market declined following concerns over US regional banks Western Alliance and Zions Bank facing loan issues, sparking fears of broader banking sector problems and causing global market declines, though some US bank shares rebounded and investors sought safe havens like gold amid heightened volatility.

US regional bank shares declined sharply due to concerns over credit risks following recent fraud disclosures, highlighting vulnerabilities in the banking sector.

Jamie Dimon warns of potential hidden risks in the US economy, highlighting recent bankruptcies of auto lenders and auto-parts suppliers that may indicate underlying financial vulnerabilities similar to those before the 2008 crisis, emphasizing the need for caution amid a seemingly strong economic environment.

A conflict has emerged between banks and private credit firms over who is better positioned to handle a potential downturn, sparked by recent losses and criticisms from industry leaders like Jamie Dimon and Marc Lipschultz, highlighting the evolving landscape of lending and financial stability concerns.