Vermont Tops 2026 ACA Premiums as U.S. Health-Costs Rise

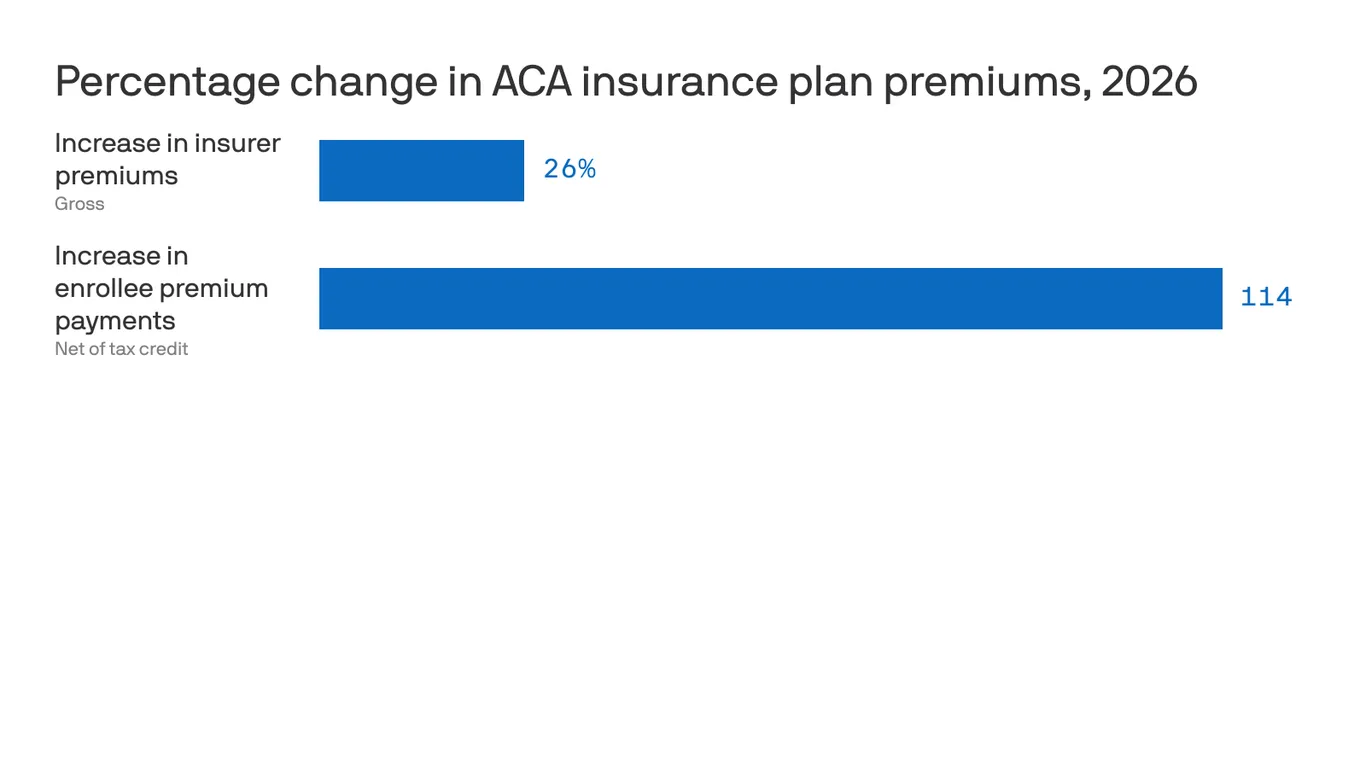

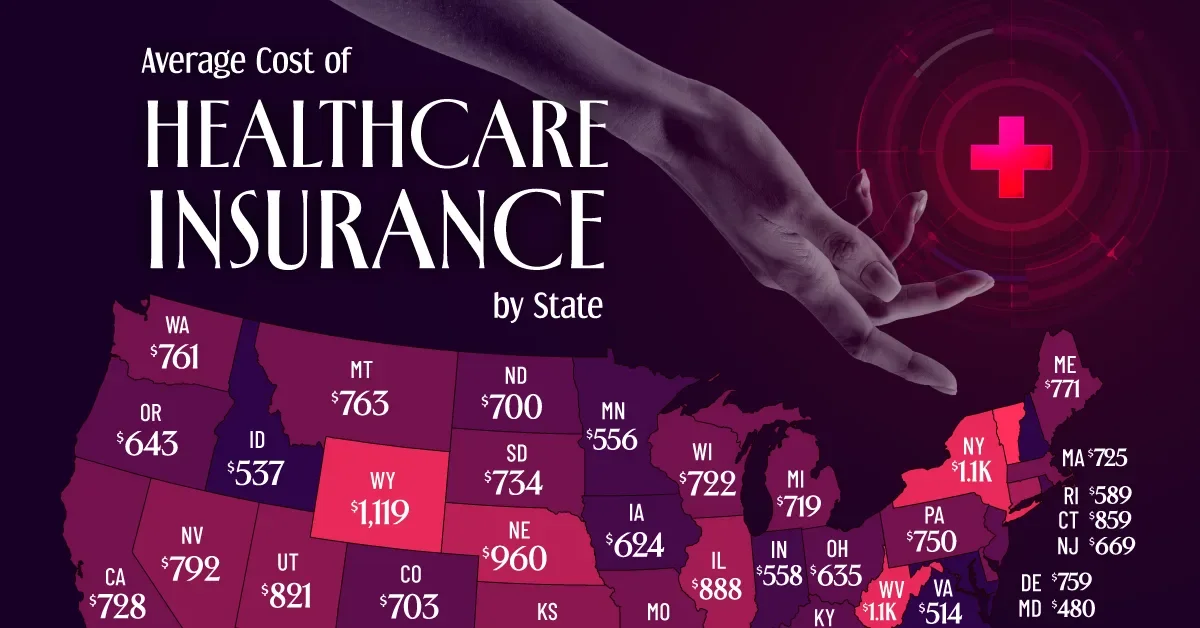

A Voronoi visualization maps 2026 average monthly ACA Silver-plan premiums by state, with Vermont highest at $1,224; the national average is $752 (up 21% from 2025) as subsidies expire and insurers raise costs. Vermont also spends about 19.6% of income on healthcare, more than triple the U.S. average of 7.9%. Maryland has the lowest premiums at $480, while other states range up to about $1,100 (Wyoming $1,119; West Virginia $1,093). Alaska is the only state with a premium decline year over year; substantial increases occur in Nebraska (29%), Illinois (30%), Florida (33%), Connecticut (21%), and Louisiana (26%).