US Economy Posts 4.3% Growth in Q3, Fastest in Two Years

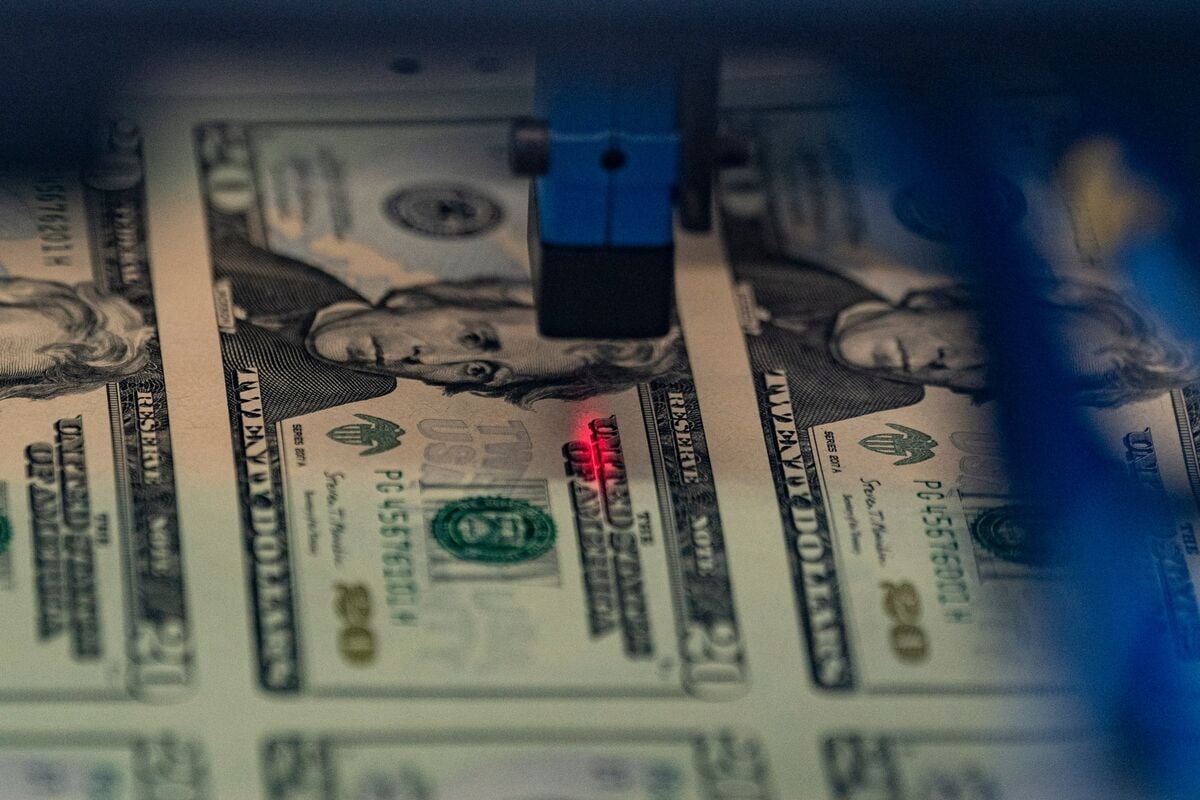

The US economy experienced strong growth in the third quarter with a 4.3% annualized GDP increase, driven by consumer spending, exports, and government expenditure, despite political and trade uncertainties. This robust performance complicates the Federal Reserve's decision on interest rates amid inflation concerns and a mixed jobs market, with recent government shutdowns impacting data collection.