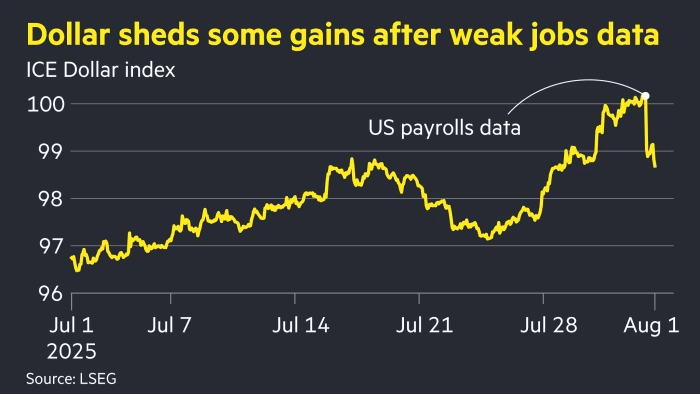

Dollar Fluctuates Amid Global Economic and Political Shifts

The US dollar edged higher against major currencies amid mixed signals on Federal Reserve interest rate policy, with some officials advocating for aggressive cuts and others emphasizing data-driven adjustments. Currency markets showed limited impact from recent geopolitical tensions, while the euro and pound experienced slight declines following softer inflation data in Europe and the UK. The Australian dollar reached over a one-year high, reflecting positive global sentiment, and overall market movements remained subdued amid ongoing economic data releases.