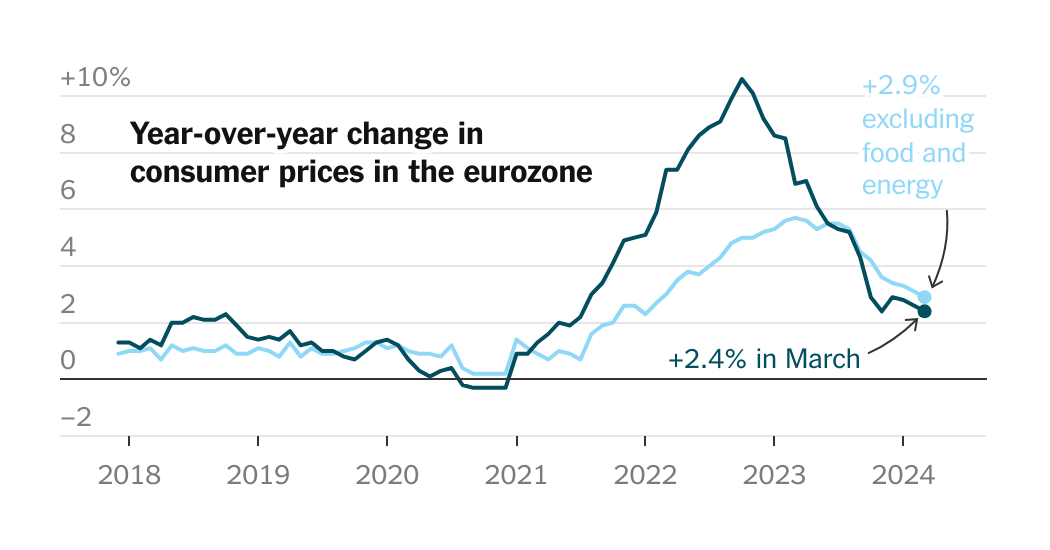

Eurozone inflation cools to 1.7%, keeping ECB on hold

Eurozone inflation slowed to 1.7% in January per Eurostat flash data, with core inflation at 2.2%. The readings support the ECB keeping its 2% policy rate steady for now, with little chance of near-term cuts, though some analysts warn policy could shift if risks evolve, including a possible hike later (potentially in 2027).