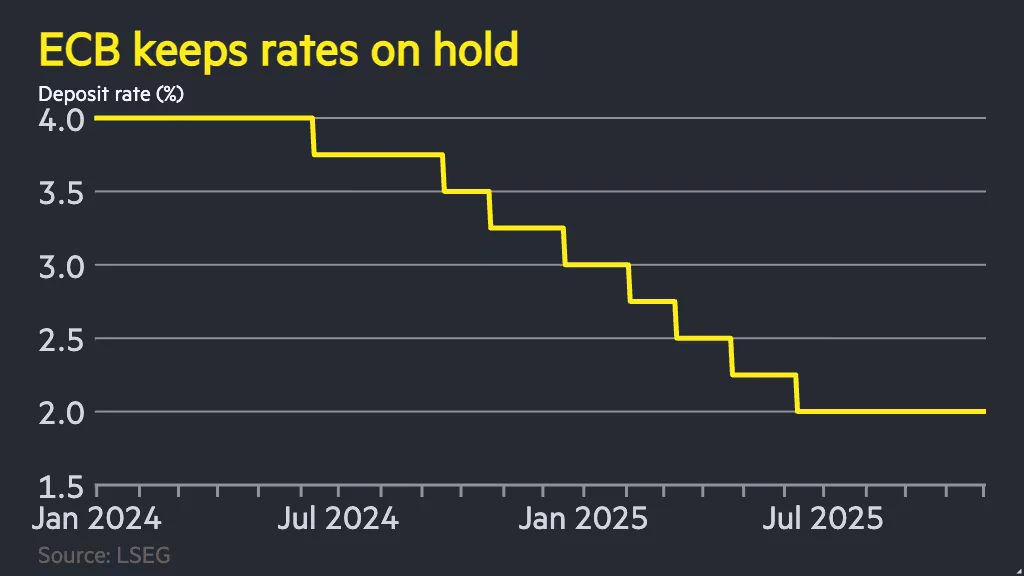

ECB Maintains Status Quo as Lagarde Exit Rumor Surfaces

Rumors that ECB President Christine Lagarde could depart before her 2027 mandate circulated, but the ECB said no decision has been made and Lagarde remains focused on her mission; the speculation centers on political timing ahead of the French elections and what a successor appointment could mean for European monetary policy.