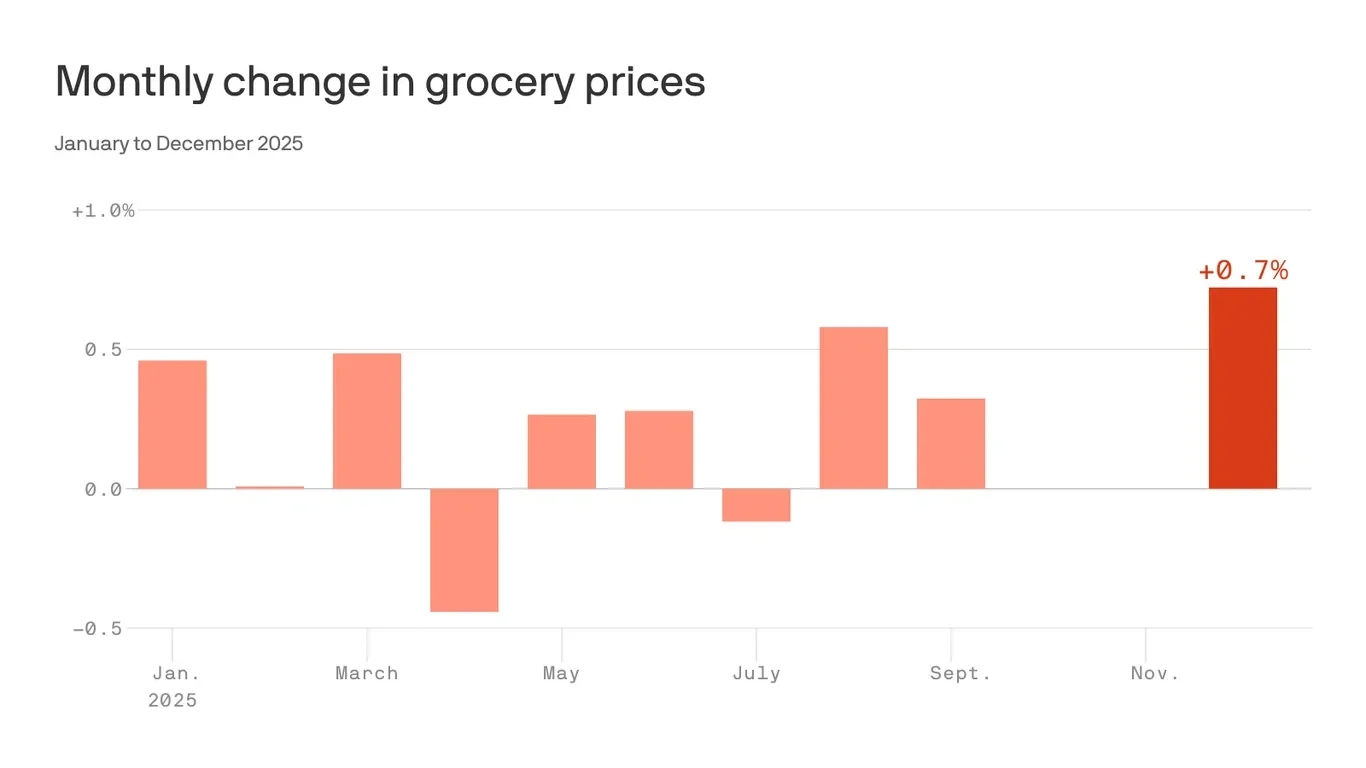

December grocery prices surge to the sharpest monthly jump since 2022

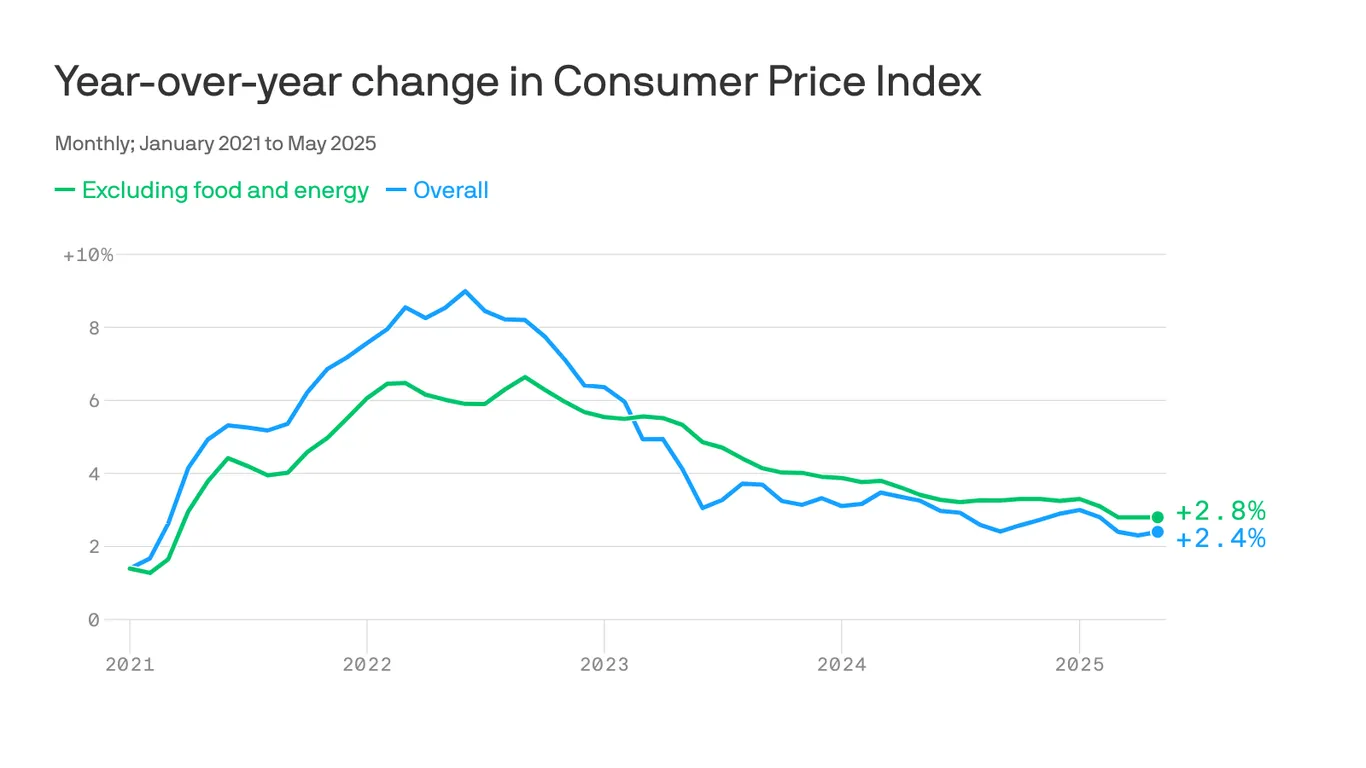

December grocery prices rose 0.7%, the fastest monthly gain since August 2022, with food-at-home up about 2.4% year over year; eggs fell more than 20% from a year ago after tariff rollbacks, but staples such as coffee, beef and candy rose double digits. The overall CPI was up 2.7% YoY and core inflation 2.6%, signaling ongoing price pressures for households even as inflation cools from its peak. Contributing factors include higher labor costs and supply disruptions from weather, disease, and the war in Ukraine, with tariffs playing a role in some price changes.