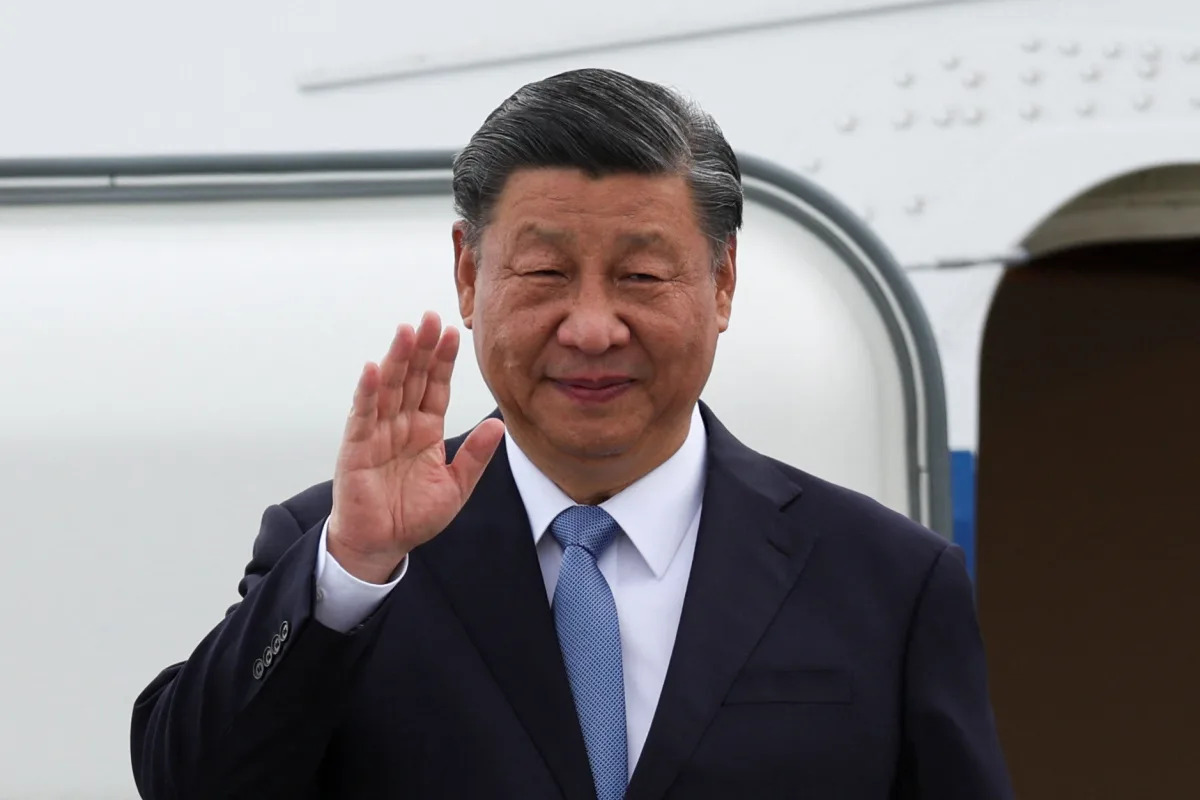

Xi Jinping Urges US CEOs to Invest in Bright Chinese Economy

Chinese President Xi Jinping met with a group of American business executives in Beijing to boost confidence in China's economy and maintain stable relations with the US. The meeting aimed to show China's openness to foreign businesses despite tensions with the US and economic challenges. China is seeking to achieve an annual growth target of around 5% and has pledged to hold regular meetings with foreign companies to address their concerns. However, investors have expressed concerns about the dual goals of development and security, as well as a structural economic slowdown.