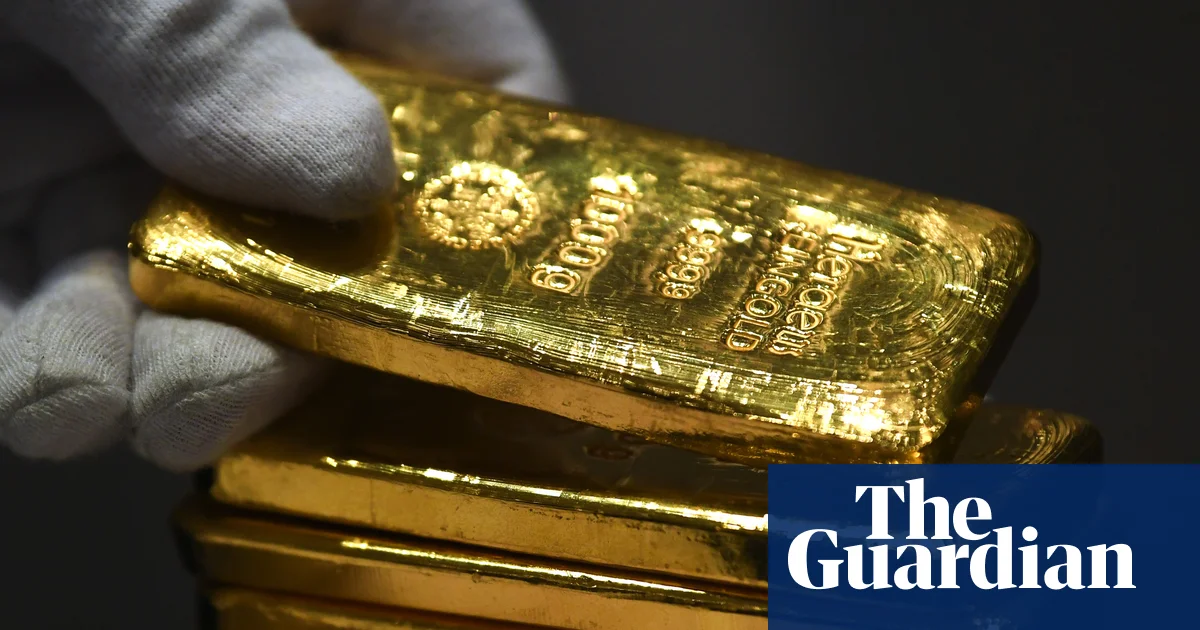

Gold Reaches Six-Week High Amid Risk-Off Sentiment and Dollar Weakness

Gold prices reached a six-week high and silver hit an all-time record, driven by expectations of US interest rate cuts and a weakening dollar, amid anticipation of key economic data and dovish signals from Fed officials.