Markets End 2025 on a Mixed Note After Record Metals and Gains

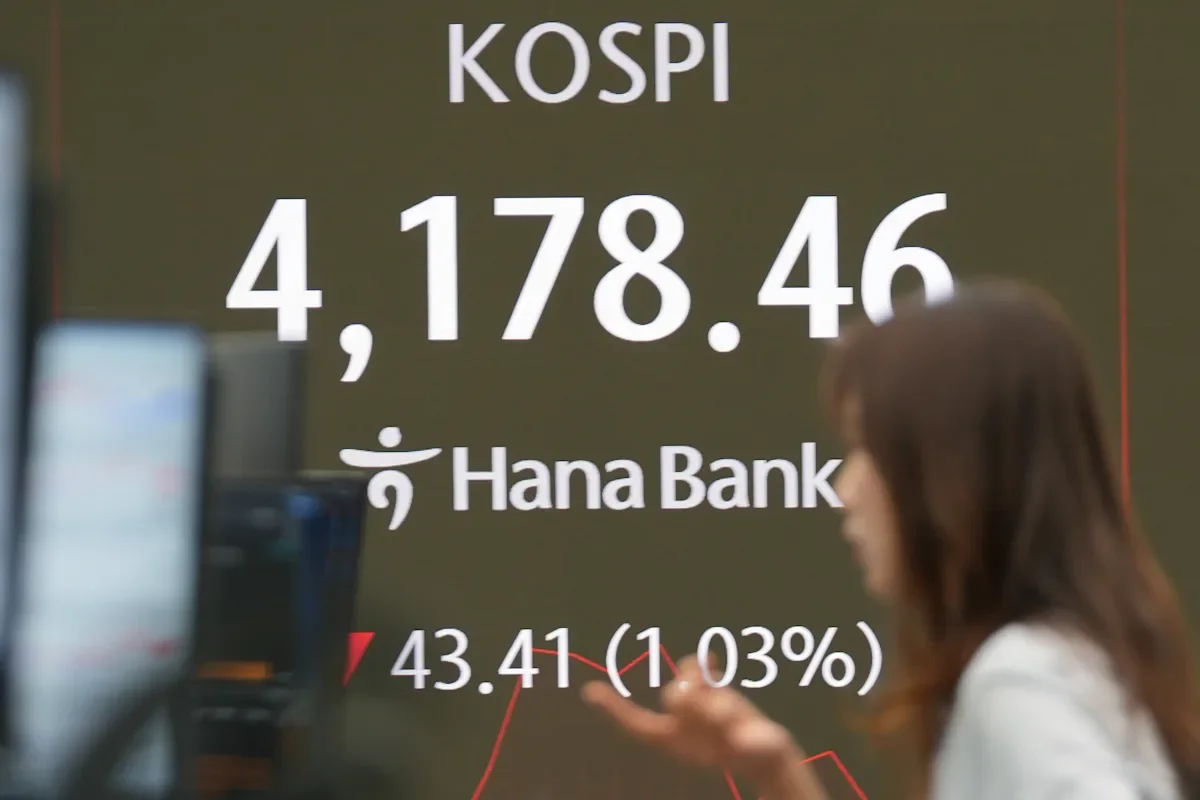

Stocks began 2026 with a focus on AI and chipmaking, driven by strong performances in Asian markets and tech giants like Samsung and TSMC, despite historical tendencies for early-year declines; optimism remains about the year's potential, supported by last year's gains and ongoing technological investments.