US GDP Surge Sparks Rate Cut Speculation Amid Holiday Party Drama

US GDP grew faster than expected in Q3, which could influence the Federal Reserve's decisions on interest rate cuts in 2026, indicating a robust economic outlook.

All articles tagged with #us gdp

US GDP grew faster than expected in Q3, which could influence the Federal Reserve's decisions on interest rate cuts in 2026, indicating a robust economic outlook.

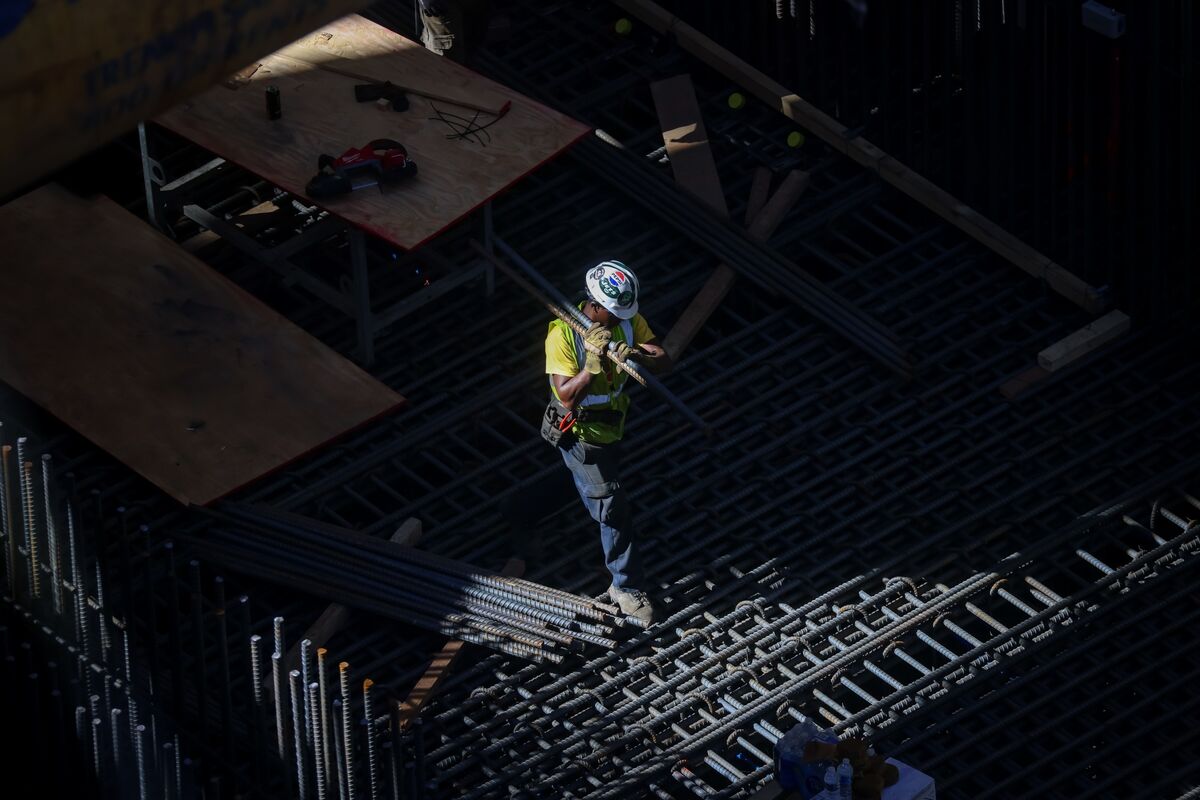

The U.S. economy grew by 4.3% in the third quarter, surpassing expectations, driven by strong consumer spending, exports, and government spending, despite ongoing inflation pressures. Corporate profits also increased significantly, indicating robust economic activity. The report was delayed due to the government shutdown and will be followed by a final estimate later.

White House adviser Kevin Hassett warned that the ongoing government shutdown is causing more severe economic damage than expected, including a potential near-term downturn in the airline industry and a slowdown in GDP growth, with consumer sentiment hitting a three-year low.

Carlyle Group has released its own estimates indicating only 17,000 jobs were created in September, suggesting a weaker US labor market amid conflicting private data and a government shutdown that delayed official employment reports. Despite this, other economic indicators point to a resilient, though cooling, US economy, with broader inflation and GDP growth remaining stable. The discrepancy between employment data and other economic signals highlights uncertainty in the current economic outlook.

The US economy grew by 3.3% in Q2, surpassing initial estimates, driven by strong consumer spending and a significant reduction in imports due to tariffs, with net exports contributing notably to growth; the economy shows resilience despite tariff-related uncertainties, with a projected slower growth rate of around 1.5% moving forward.

New US tariffs announced in 2023 are expected to reduce the US GDP by 0.36% and negatively impact most global economies, with Switzerland, Thailand, and Taiwan experiencing significant declines, while Australia and the UK may see slight gains. The tariffs, which are part of a broader trade policy, have caused market volatility and are likely to continue affecting international trade and economic stability.

The US Federal Reserve is expected to keep interest rates unchanged amid strong GDP growth and political pressure from President Trump, who has criticized the Fed's independence and targeted its policies and renovations, while the economy shows resilience despite tariffs and inflation concerns.

The US economy grew by 3% in Q2, surpassing expectations, driven by a rebound in trade balance and consumer spending, despite ongoing tariffs and trade tensions.

A new US GDP report suggests the economy has grown at a 2.3% annualized rate in the second quarter, defying fears of a tariff-induced slowdown, with resilient consumer spending and a low unemployment rate, while the impact of tariffs on trade and imports complicates the overall picture. The Federal Reserve is expected to keep interest rates steady amid these mixed signals.

The OECD reports that President Trump's tariffs are expected to slow global economic growth, with US GDP projected to decline from 2.8% in 2024 to around 1.5-1.6% in 2025-2026 if the tariffs remain in place, especially if trade disputes persist.

The US economy contracted by 0.2% in Q1 2025, marking its first decline since 2022, primarily due to increased imports driven by tariff fears and a slowdown in consumer spending, amid ongoing trade tensions and policy uncertainties.

Chinese markets stabilize after a cut in bank reserve requirements, but global investors remain cautious due to economic underperformance and regulatory risks. Attention turns to the European Central Bank policy meeting and President Christine Lagarde's press conference, with market expectations for a rate cut in April. In corporate news, luxury retailer LVMH is set to report earnings, while U.S. companies like Netflix and IBM experience significant stock movements based on subscriber growth and earnings forecasts. Additionally, U.S. GDP data and a slew of corporate earnings reports, including from Intel and Visa, are expected to influence markets.

The US GDP figure is expected to influence the sentiment of the day, with the S&P 500 and Nasdaq outlook dependent on whether the figure leads to a corrective phase or a continuation of the upward trend. The bond market is already anticipating rate cuts, with corporate bonds performing well and financial conditions easing.

The US economy grew at a stronger pace than previously indicated in the third quarter, with a 5.2% annualized GDP growth rate. The upward revision was driven by better-than-expected business investment and increased government spending. However, consumer spending saw a downward revision. Inflation remained mixed, with a slight downward revision in the personal consumption expenditures price index but an upward move in the chain-weighted price index. Corporate profits also accelerated during the period.

Federal Reserve Governor Christopher Waller described the third-quarter US GDP growth of 4.9% as a "blowout" performance, but more recent data suggests a slowdown. Manufacturing and job growth cooled in October, a bank loan officers survey showed credit tightening and a drop in loan demand, and a New York Fed report noted a rise in consumer loan delinquencies. The Atlanta Fed's GDPNow model predicts a sharp drop in fourth-quarter GDP growth to 2.1%, which may prompt the Fed to hold interest rates steady in December. Rising debt stress and signs of a cooling labor market are also factors being considered by the Fed.