US Multinationals to Benefit from Global Minimum Tax Relief

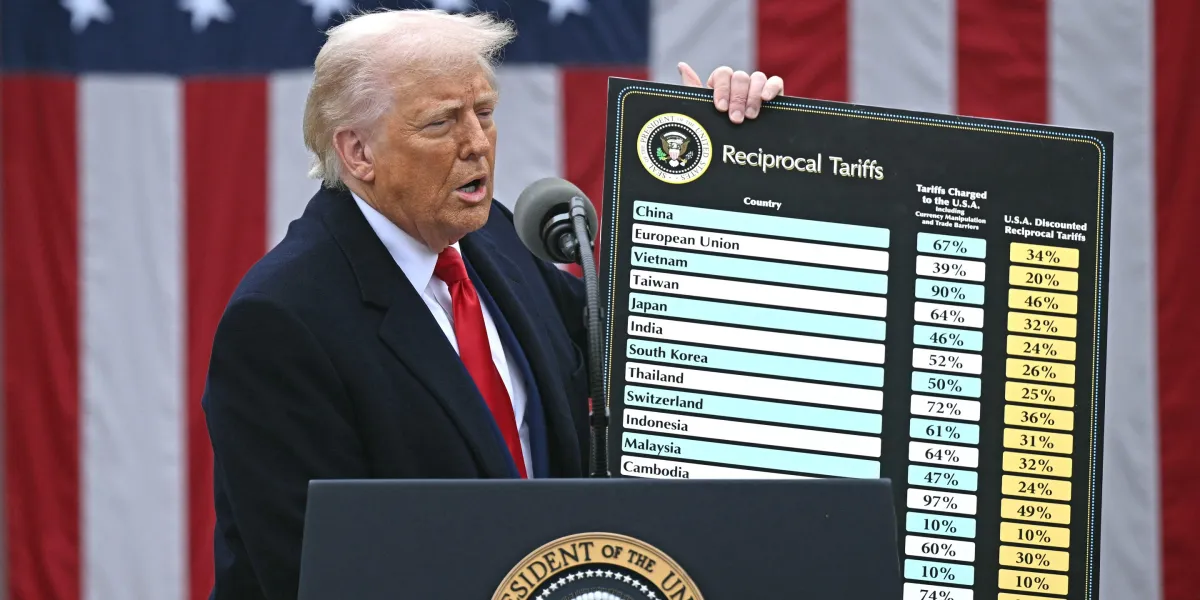

The OECD has finalized a global tax deal that exempts U.S.-based multinational corporations from paying a 15% minimum tax overseas, amid negotiations that aimed to curb profit shifting to low-tax havens, with mixed reactions from different political and advocacy groups.