2026 Stock Market Outlook: Navigating Turbulence and Opportunities

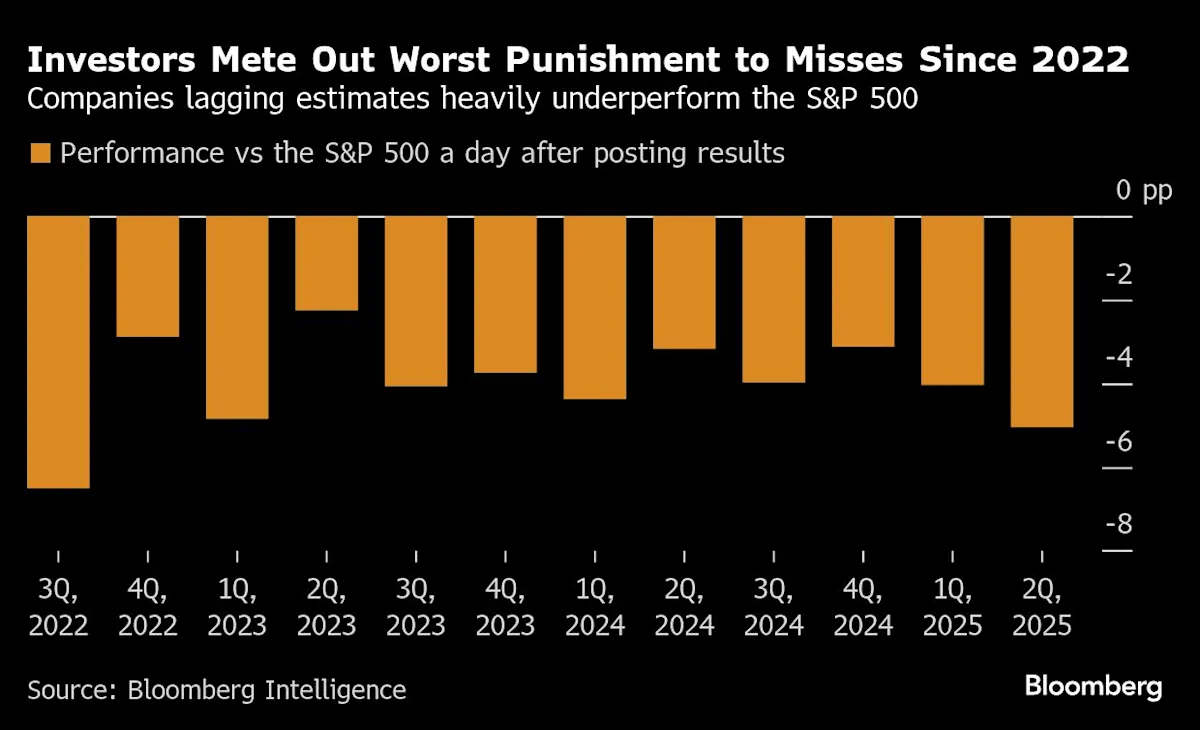

U.S. stocks had a strong 2025, driven by tech and AI, with corporate America turning economic challenges into profits. Despite risks like geopolitical tensions and debt concerns, profits are expected to continue rising in 2026, supported by favorable monetary policy and tax reforms, indicating a healthy market outlook.