US growth outpaces hiring as job market cools

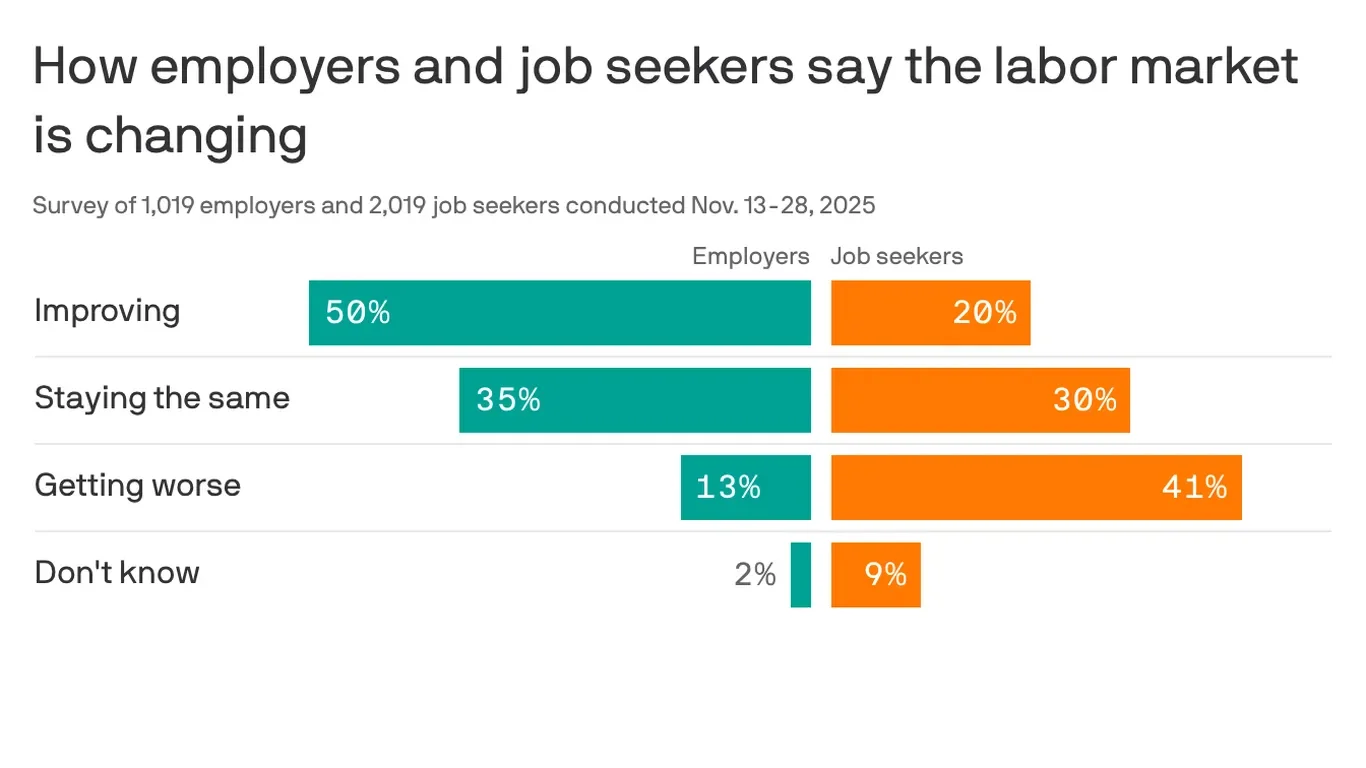

The US economy is expanding at a robust pace while job openings and hiring have fallen to multi-year lows, leaving some workers unemployed or underemployed despite strong growth. Analysts point to factors like AI-driven efficiency, outsourcing, immigration policy, and fiscal uncertainty as possible causes, with experts cautioning the trend could be temporary or longer-lasting.