Gold Steady Amid US Data, Eyes Weekly Gains

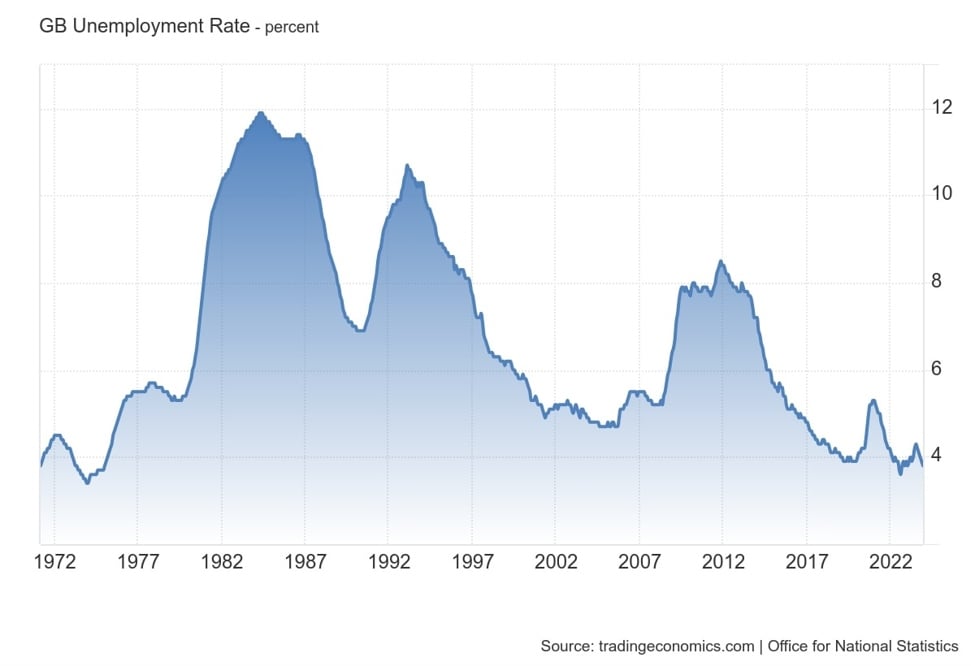

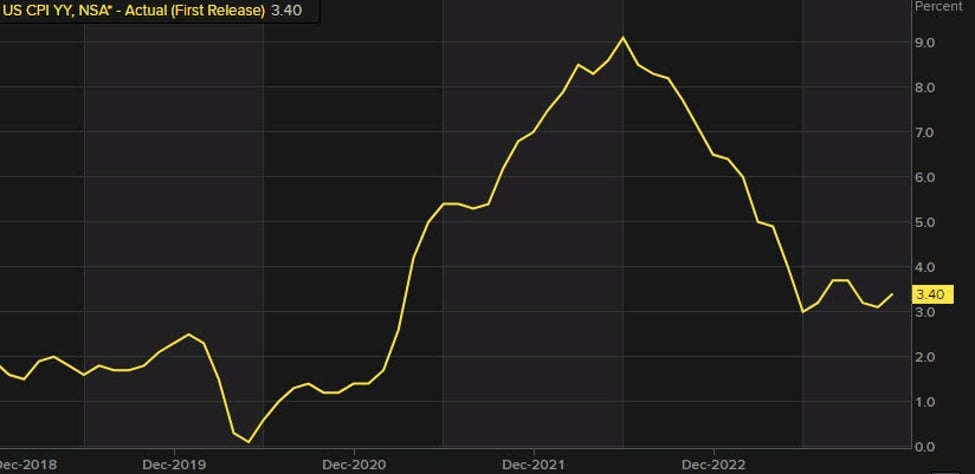

Gold prices slightly declined as US inflation data showed a softer-than-expected increase, reducing its appeal as an inflation hedge, though support from a higher unemployment rate limited losses. Silver retreated from record highs, while platinum and palladium reached multi-year highs due to strong demand and supply concerns.