"Market Anticipation: US CPI Report and Its Impact on Stocks and the Dollar"

TL;DR Summary

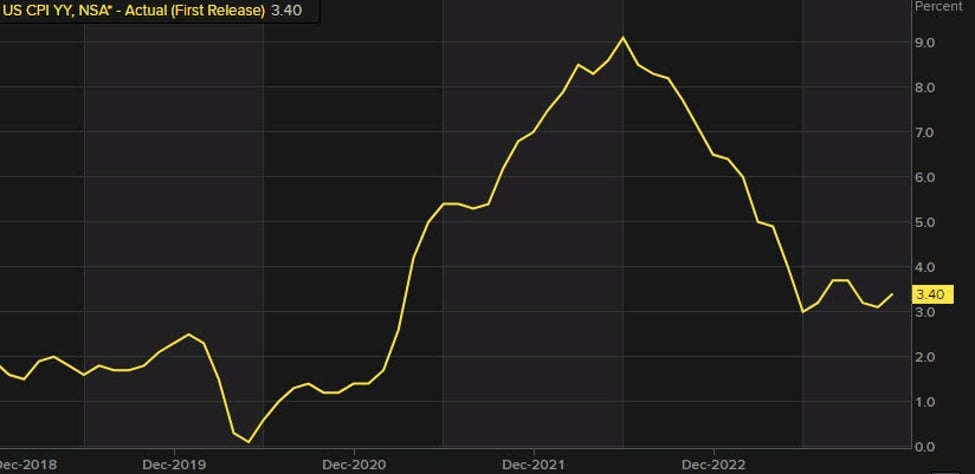

The upcoming US CPI report is expected to show a y/y reading of 2.9%, down from 3.4% in December, with core CPI slowing to 3.7% y/y from 3.9%. The market may focus on core CPI, and a 0.1 pp beat could impact US 10s and the dollar. The report will provide insight into the Fed's philosophical stance on inflation and interest rates, with the market currently pricing in a 71% chance of a rate cut on May 1, potentially stretching out until June.

- Preview: What's expected for Tuesday's US CPI report? ForexLive

- Inflation expected to fall below 3% for the first time since March 2021 Yahoo Finance

- Stocks steady, dollar up; investors brace for CPI Reuters

- Slower US Inflation Is Set to Fuel Fed Cut Optimism Bloomberg

- Dow Jones, Nasdaq, S&P 500 weekly preview: January CPI report takes the central stage By Investing.com Investing.com

Reading Insights

Total Reads

0

Unique Readers

8

Time Saved

1 min

vs 2 min read

Condensed

70%

278 → 83 words

Want the full story? Read the original article

Read on ForexLive