The Unseen Potential of House Republicans

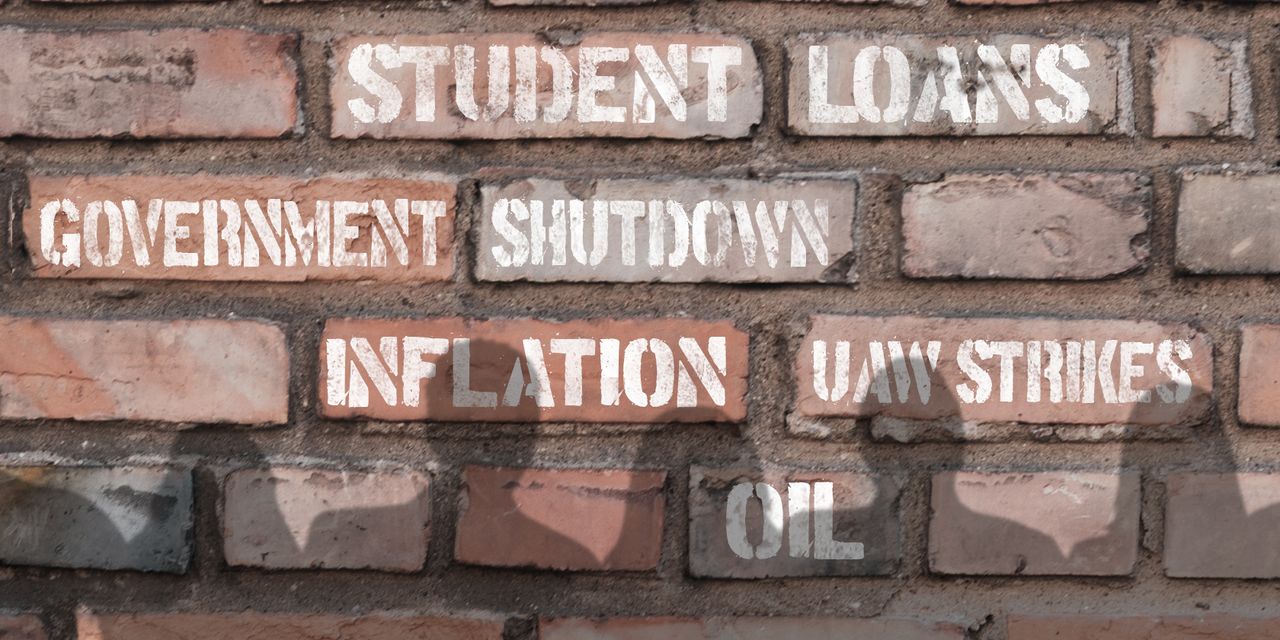

House Republicans, amidst their internal conflicts and leadership changes, have lost sight of their original purpose of cutting federal spending. However, the bond market is signaling that the massive issuance of US debt may be reaching unsustainable levels, causing long-term rates to rise and creating turbulence in the stock market. The federal deficit for fiscal 2023 reached $1.7 trillion, and with rising rates, the government's borrowing costs are set to increase significantly. The average interest rate the US government pays on its debt has risen to nearly 3%, the highest level since 2011, and is expected to continue rising. This combination of excessive borrowing and higher interest rates poses a serious threat to the government's financial situation, with interest payments potentially surpassing defense spending. While Republicans have a history of advocating for spending cuts, they often avoid addressing the core issues and fail to propose comprehensive solutions. However, the market is suggesting that it may be time to address the growing federal debt through a combination of higher taxes, reduced benefits, and other measures.