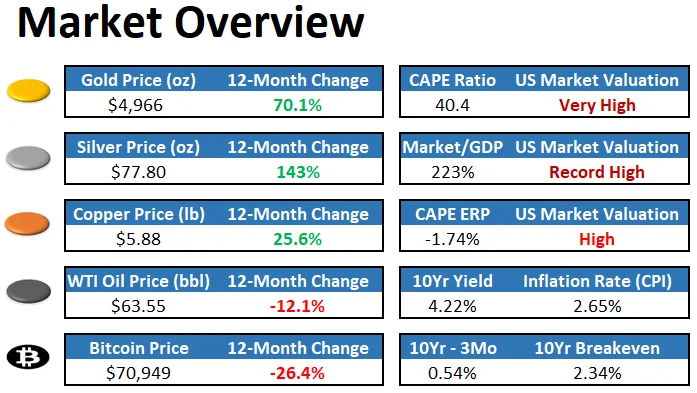

Fed’s Gentle Print Rewrites the Market Playbook

The newsletter describes the Fed’s shift from shrinking reserves to a gradual balance-sheet expansion (starting with about $40B/month and a baseline of $20–$25B/month) to maintain ample reserves and control rates, a milder form of stimulus that could mildly support asset prices. It explains the difference between QE and reserve-management purchases, outlines possible 2026 scenarios and shocks, analyzes Japan’s rising yields and potential yield-curve actions, and notes a volatile but enduring precious-metals trade alongside portfolio updates. Overall, policy is expected to be modestly supportive for assets while emphasizing valuations and diversification.